Question: 5. Consider the following two mutually exclusive projects: Wroject A has an initial cost of $-318,844 and the following Cash flows: Year 1 $27,700 Year

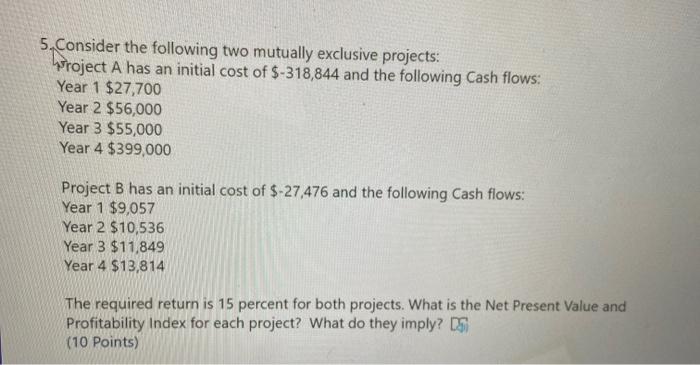

5. Consider the following two mutually exclusive projects: Wroject A has an initial cost of $-318,844 and the following Cash flows: Year 1 $27,700 Year 2 $56,000 Year 3 $55,000 Year 4 $399,000 Project B has an initial cost of $-27,476 and the following Cash flows: Year 1 $9,057 Year 2 $10,536 Year 3 $11,849 Year 4 $13,814 The required return is 15 percent for both projects. What is the Net Present Value and Profitability Index for each project? What do they imply? DS (10 Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts