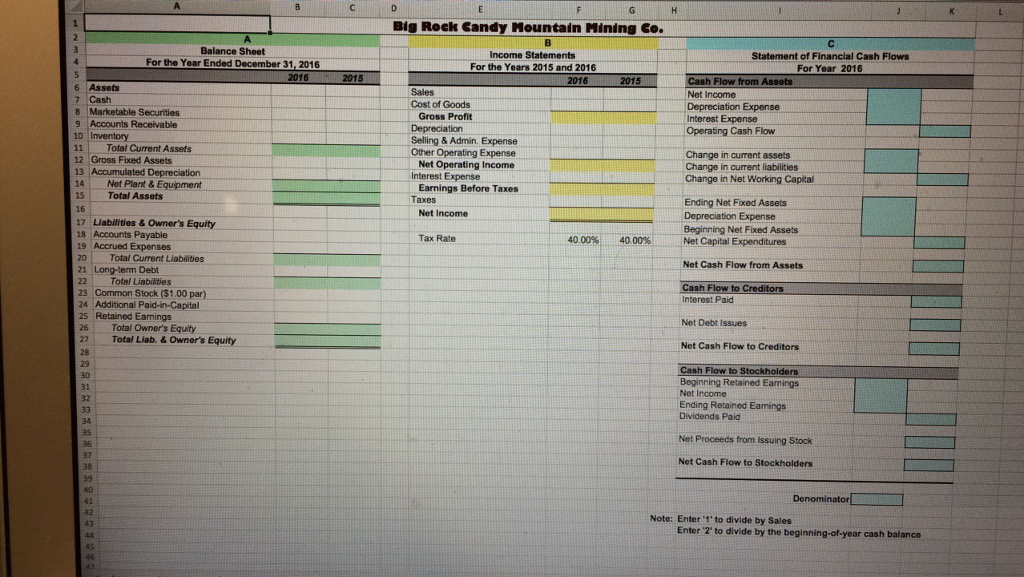

Question: 5. Create the following using formulas that reference the financial information in worksheet 4. A. Common-size balance sheet for 2015 and 2016 that reports line

5. Create the following using formulas that reference the financial information in worksheet 4.

A. Common-size balance sheet for 2015 and 2016 that reports line items as percentages of total assets. Retain borders by using Paste Special > Formulas and number formats.

B. Common-size income statement for 2015 and 2016 that reports line items as percentages of total sales. Retain borders by using Paste Special > Formulas and number formats.

C. Common-size statement of financial cash flows for 2016 that reports line items as percentages of 2016 sales and the 2016 beginning-of-year cash balance. Use the CHOOSE function in the formulas so that one can switch between the two types of percentages using an index number of 1 or 2 in cell J40. Retain borders by using Paste Special > Formulas and number formats

If someone could help me answer these (the blank cells) showing the formulas and numbers. It would be much appreciated! Thanks!

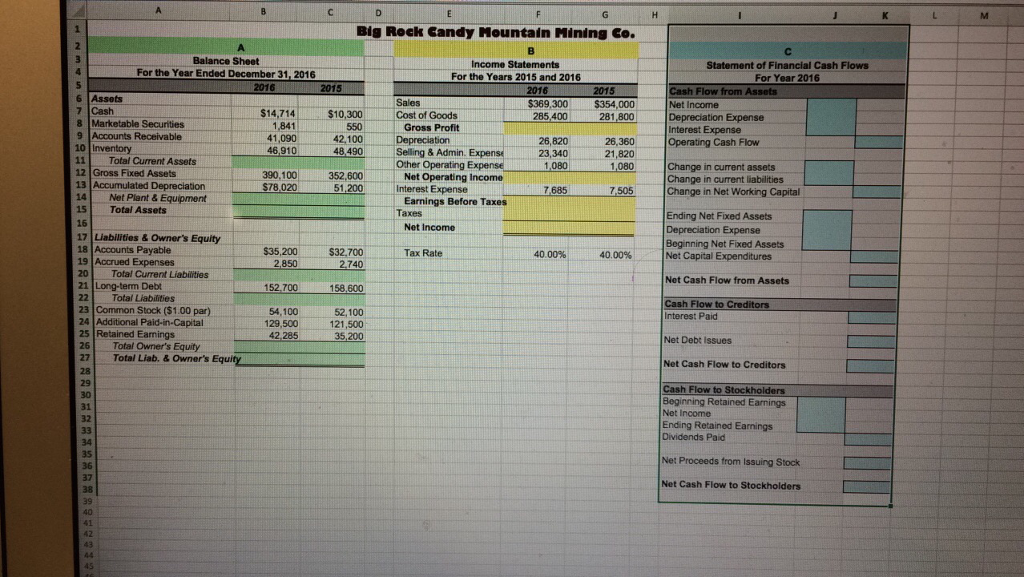

Does this second sheet help with the information you thought was missing? That was from the problem before.

Big Rock Candy Mountain Mining Co. Statement of Financial Cash Flows For Year 2016 For the Year Ended December 31, 2016 For the Years 2015 and 2016 2016 2016 h Flow from Assets 6 Assets 7 Cash Net Income Cost of Goods Gross Profit Interest Expense Operating Cash Flow 9 Accounts Receivable 10 Inventory 11Total Current Assets 12 Gross Fixed Assets Selling & Admin. Expense Other Operating Expense Accumulated Depreciation 14 Net Plant & Equipment 15 Total Assets Net Operating Income Interest Expense Change in current assets Change in current liabilities Change in Net Working Capital 2 Ending Net Fixed Assets Depreciation Expense Beginning Net Fixed Assets Net Income 17 Liabilities & Owner's Equity 18 Accounts Payable 19 Accrued Expenses 20Total Current Liabilities 21 Long-term Debt 22Total Liabilties Tax Rate 4000% 4000% Net Capital Expenditures Net Cash Flow from Assets Cash Flow to Common Stock ($1.00 par) 25 Retained Earnings 26Total Owner's Equity 27 Net Debt Issues Total Liab. & Owner's Equity Net Cash Flow to Creditors Cash Flow to Beginning Retained Eamings Net Income Ending Reained Eamings Dividends Paid Net Proceeds from Issuing Net Cash Flow to Stockholders Note: Enter '1' to divide by Sales Enter 2' to divide by the beginning-of-year cash balance Big Rock Candy Mountain Mining Co. Statement of Financial Cash Flows For Year 2016 For the Year Ended December 31, 2016 For the Years 2015 and 2016 2016 2016 h Flow from Assets 6 Assets 7 Cash Net Income Cost of Goods Gross Profit Interest Expense Operating Cash Flow 9 Accounts Receivable 10 Inventory 11Total Current Assets 12 Gross Fixed Assets Selling & Admin. Expense Other Operating Expense Accumulated Depreciation 14 Net Plant & Equipment 15 Total Assets Net Operating Income Interest Expense Change in current assets Change in current liabilities Change in Net Working Capital 2 Ending Net Fixed Assets Depreciation Expense Beginning Net Fixed Assets Net Income 17 Liabilities & Owner's Equity 18 Accounts Payable 19 Accrued Expenses 20Total Current Liabilities 21 Long-term Debt 22Total Liabilties Tax Rate 4000% 4000% Net Capital Expenditures Net Cash Flow from Assets Cash Flow to Common Stock ($1.00 par) 25 Retained Earnings 26Total Owner's Equity 27 Net Debt Issues Total Liab. & Owner's Equity Net Cash Flow to Creditors Cash Flow to Beginning Retained Eamings Net Income Ending Reained Eamings Dividends Paid Net Proceeds from Issuing Net Cash Flow to Stockholders Note: Enter '1' to divide by Sales Enter 2' to divide by the beginning-of-year cash balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts