Question: 5. Deductions. (Obj. 3) Use the knowledge you have acquired from Chapters 1 through 6 to identify each of the following expenditures as (A) deductible

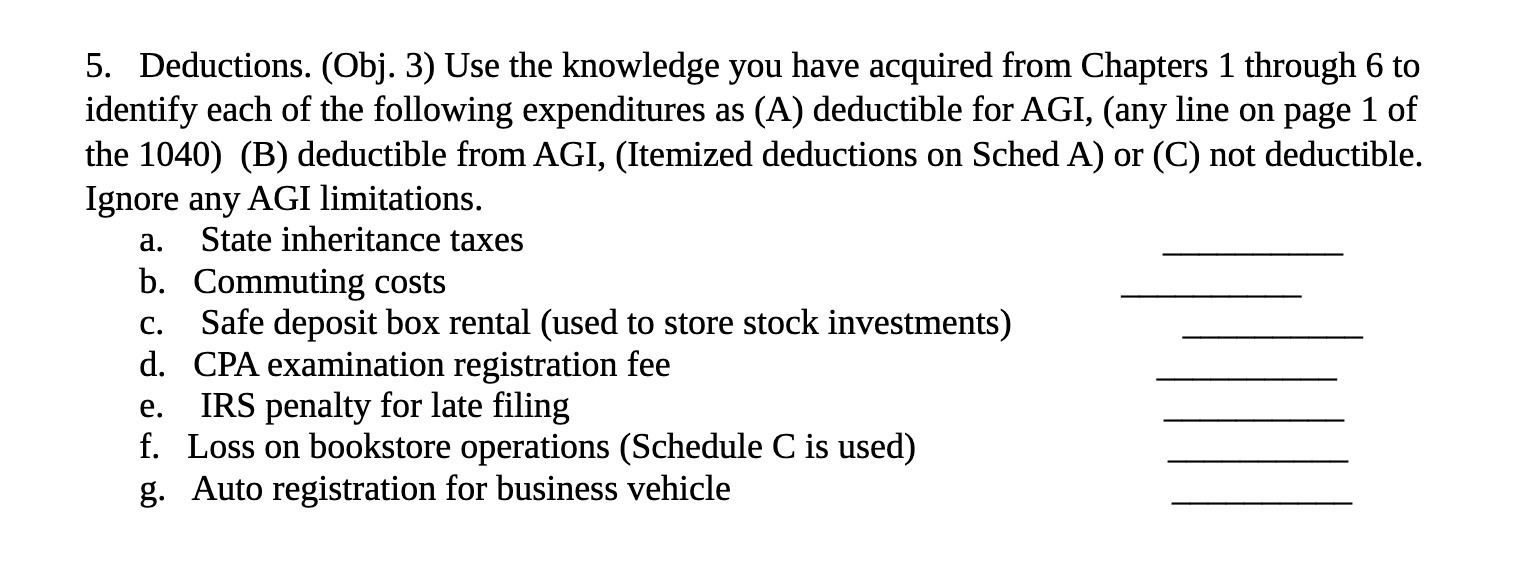

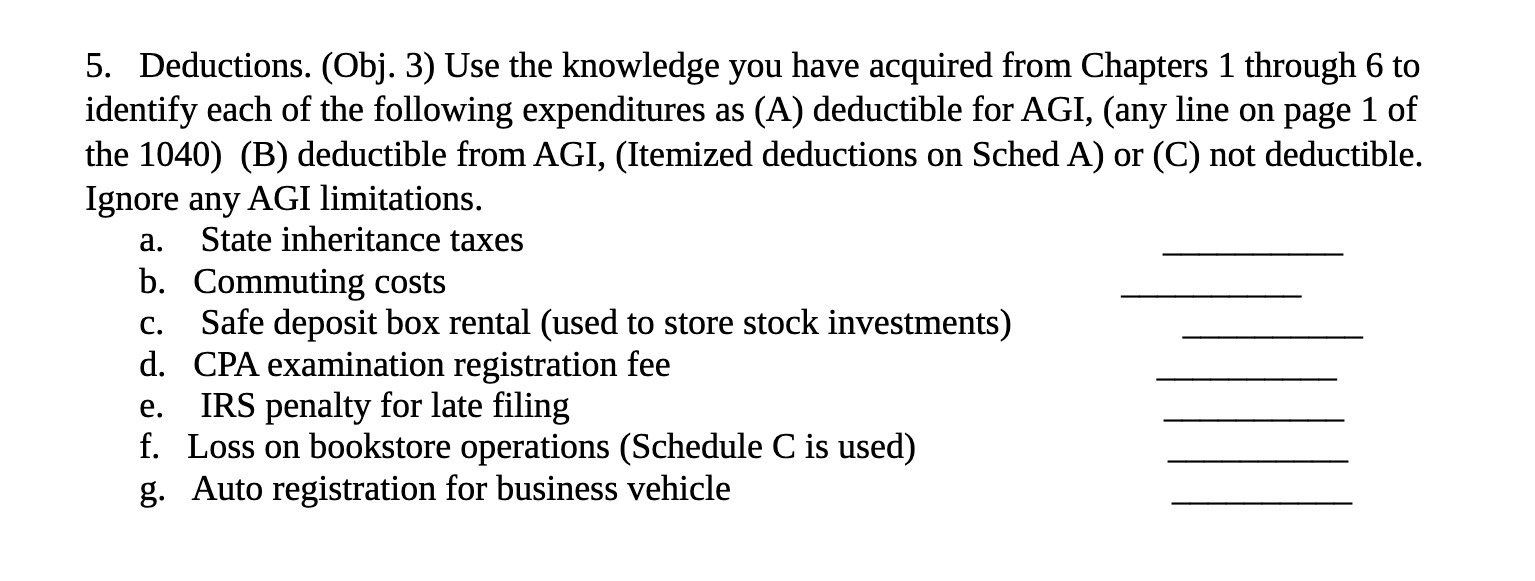

5. Deductions. (Obj. 3) Use the knowledge you have acquired from Chapters 1 through 6 to identify each of the following expenditures as (A) deductible for AGI, (any line on page 1 of the 1040) (B) deductible from AGI, (Itemized deductions on Sched A) or (C) not deductible. Ignore any AGI limitations. a. State inheritance taxes b. Commuting costs c. Safe deposit box rental (used to store stock investments) d. CPA examination registration fee e. IRS penalty for late filing f. Loss on bookstore operations (Schedule C is used) g. Auto registration for business vehicle

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts