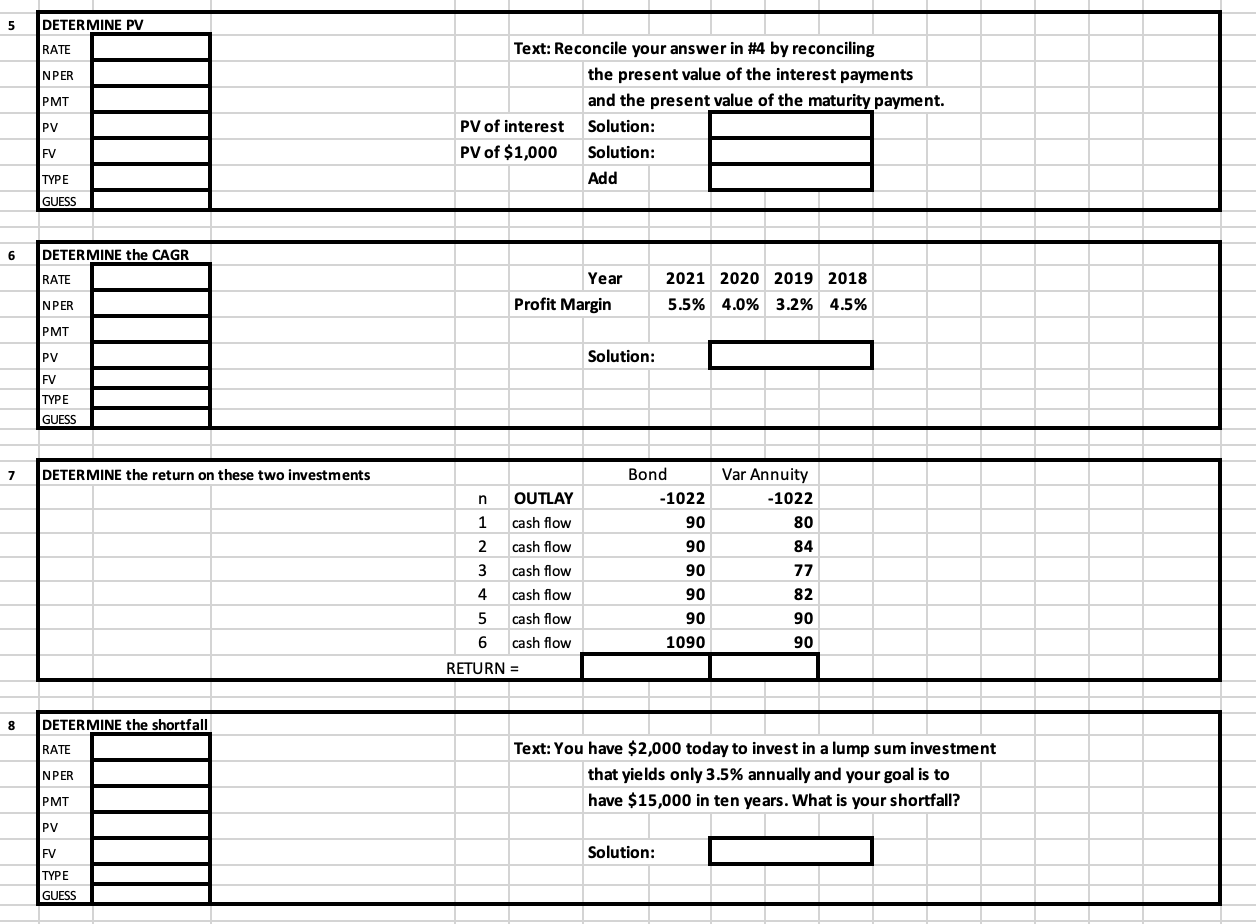

Question: 5 DETERMINE PV RATE NPER PMT Text: Reconcile your answer in #4 by reconciling the present value of the interest payments and the present value

5 DETERMINE PV RATE NPER PMT Text: Reconcile your answer in #4 by reconciling the present value of the interest payments and the present value of the maturity payment. PV of interest Solution: PV of $1,000 Solution: Add PV FV TYPE GUESS 6 DETERMINE the CAGR RATE Year Profit Margin 2021 2020 2019 2018 5.5% 4.0% 3.2% 4.5% NPER PMT Solution: PV FV TYPE GUESS 7 DETERMINE the return on these two investments Bond -1022 90 90 Var Annuity -1022 80 84 77 82 90 90 n OUTLAY 1 cash flow 2 cash flow 3 cash flow 4 cash flow 5 cash flow 6 cash flow RETURN = 90 90 90 1090 8 DETERMINE the shortfall RATE NPER Text: You have $2,000 today to invest in a lump sum investment that yields only 3.5% annually and your goal is to have $15,000 in ten years. What is your shortfall? PMT PV Solution: FV TYPE GUESS 5 DETERMINE PV RATE NPER PMT Text: Reconcile your answer in #4 by reconciling the present value of the interest payments and the present value of the maturity payment. PV of interest Solution: PV of $1,000 Solution: Add PV FV TYPE GUESS 6 DETERMINE the CAGR RATE Year Profit Margin 2021 2020 2019 2018 5.5% 4.0% 3.2% 4.5% NPER PMT Solution: PV FV TYPE GUESS 7 DETERMINE the return on these two investments Bond -1022 90 90 Var Annuity -1022 80 84 77 82 90 90 n OUTLAY 1 cash flow 2 cash flow 3 cash flow 4 cash flow 5 cash flow 6 cash flow RETURN = 90 90 90 1090 8 DETERMINE the shortfall RATE NPER Text: You have $2,000 today to invest in a lump sum investment that yields only 3.5% annually and your goal is to have $15,000 in ten years. What is your shortfall? PMT PV Solution: FV TYPE GUESS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts