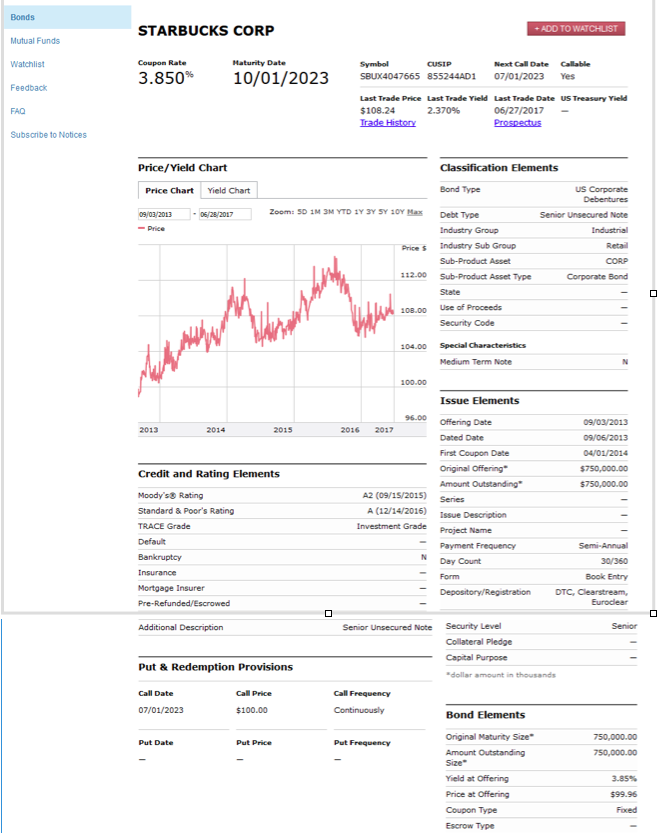

Question: 5. ( EXCEL ) Use the information for a Starbucks bond shown on the next page to answer the following questions. NOTE: You should assume

5. (EXCEL) Use the information for a Starbucks bond shown on the next page to answer the following questions. NOTE: You should assume that todays date is 10/1/2017. Do not use continuous interest rates:

| a) Use the Present Value (PV) function to find the duration. Hints: Each row should be treated as a separate cash flow. In other words, you will NOT enter an amount in the PMT box. When finding the present value of each individual payment amount, use Pmt Number to indicate the number of periods for discounting. This is a semi-annual bond so the total number of payments will be years to maturity x 2. When calculating the duration, use Duration Time in the calculation.

|

c) Use the duration number to calculate how much the value of the bond will change if the interest rate increases by 0.1 percent.

Bonds STARBUCKS CORP ADD TO WATCHLIST Mutual Funds Coupon Rate Maturity Date Next Call Date Callable 3.850% 10/01/2023 seux4047665855244AD1 07/01/2023 Yes Last Trade Date US Treasury Yield 06/27/2017- Last Trade Price Last Trade Yield FAQ $108.24 Subscribe to Notices Price/Yield Chart Classification Elements Price Chart Yield Chart Bond Type US Corporate Debt Type Senior Unsecured Note Price Industry Group Price s Industry Sub Group Sub-Product Asset CORP 12.00 Sub-Product Asset Type Corporate Bond .Use of Proceeds Security Code 104.00 Special Characteristics Medium Term Note Issue Elements 96.00 offering Date 2013 2015 2016 2017 Dated Date First Coupon Date Original Offering Amount Outstanding* Credit and Rating Elements Moodys8 Rating Standard & Poor's Rating TRACE Grade Defau A2 (09/15/2015) Series A (12/14/2016) Issue Description Investment Grade Project Name Payment Frequency Day Count Form 30/360 Book Entry DTC, Clearstream, Mortgage Insurer Senior Unsecured Note Secunity Level Collateral Pledge Capital Purpose dollar amount in thousands Put & Redemption Provisions Call Date Call Price Call Frequency 07/01/2023 $100.00 Bond Elements Original Maturity Size Amount Outstanding Put Date Put Frequency Size Yield at offering Price at Offering Coupon Type Escrow Type 99.96

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts