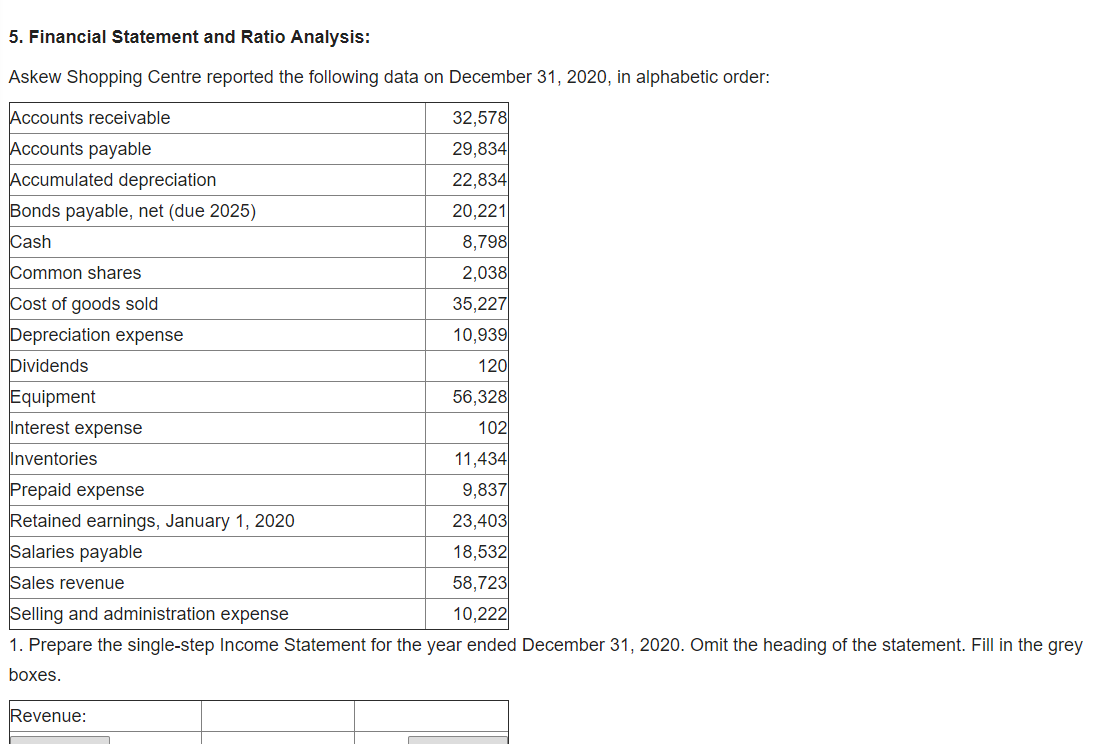

Question: 5. Financial Statement and Ratio Analysis: Askew Shopping Centre reported the following data on December 31, 2020, in alphabetic order: Cash Accounts receivable 32,578 Accounts

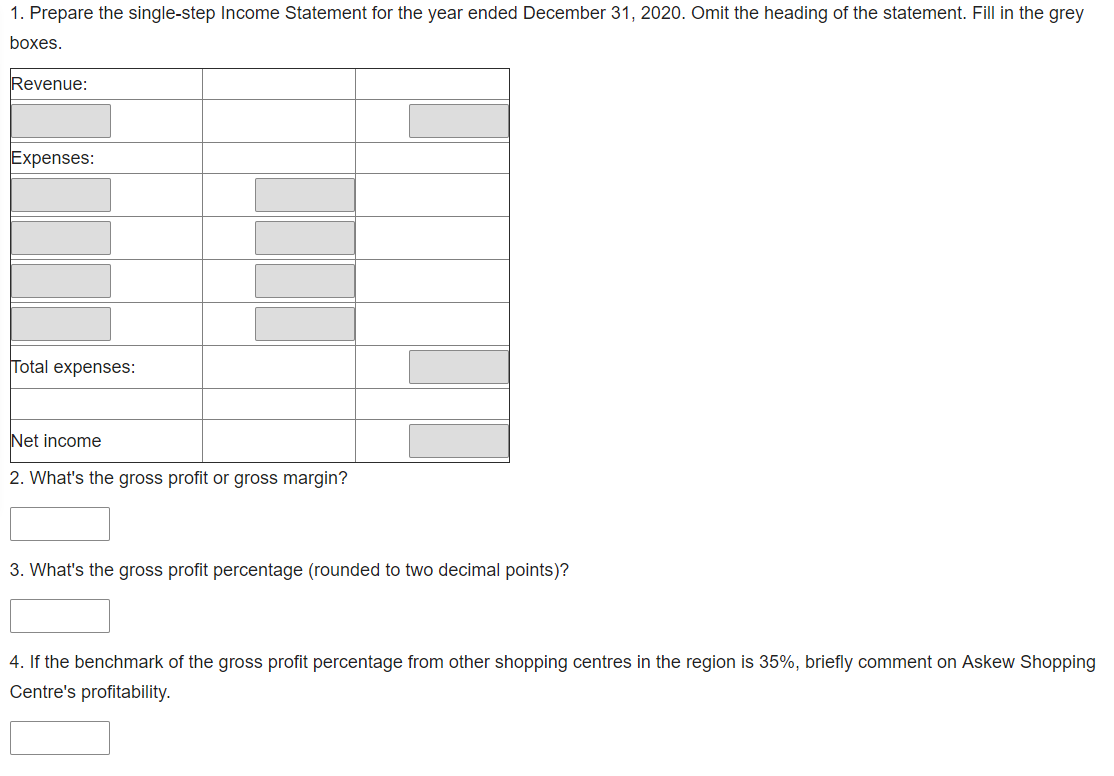

5. Financial Statement and Ratio Analysis: Askew Shopping Centre reported the following data on December 31, 2020, in alphabetic order: Cash Accounts receivable 32,578 Accounts payable 29,834 Accumulated depreciation 22,834 Bonds payable, net (due 2025) 20,221 8,798 Common shares 2,038 Cost of goods sold 35,227 Depreciation expense 10,939 Dividends 120 Equipment 56,328 Interest expense 102 Inventories 11,434 Prepaid expense 9,837 Retained earnings, January 1, 2020 23,403 Salaries payable 18,532 Sales revenue 58,723 Selling and administration expense 10,222 1. Prepare the single-step Income Statement for the year ended December 31, 2020. Omit the heading of the statement. Fill in the grey boxes. Revenue: 1. Prepare the single-step Income Statement for the year ended December 31, 2020. Omit the heading of the statement. Fill in the grey boxes. Revenue: Expenses: Total expenses: Net income 2. What's the gross profit or gross margin? 3. What's the gross profit percentage (rounded to two decimal points)? 4. If the benchmark of the gross profit percentage from other shopping centres in the region is 35%, briefly comment on Askew Shopping Centre's profitability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts