Question: Exercise 4.12 (The chooser option). This is also called the As You Like It option. The chooser option is discussed in Hull, [37] pages 4612.

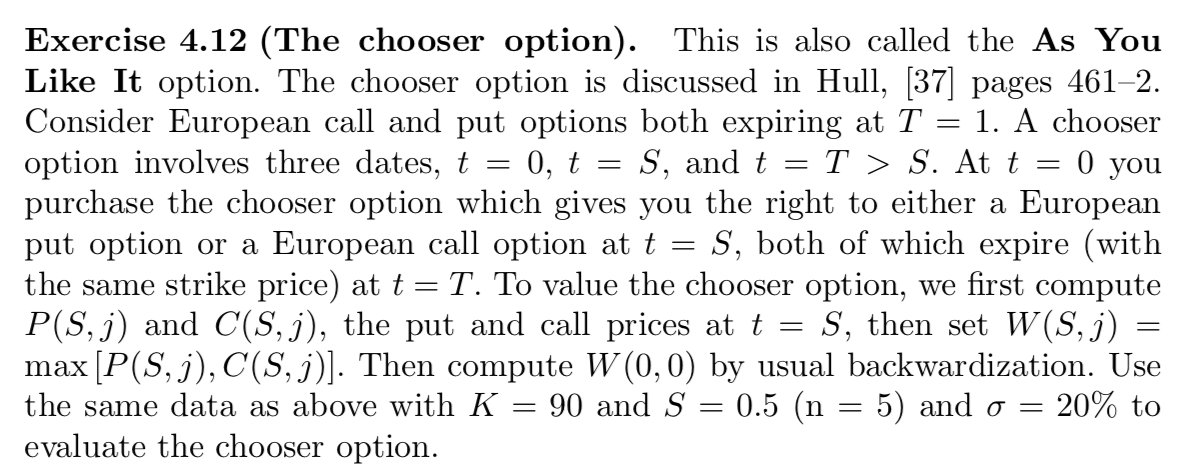

Exercise 4.12 (The chooser option). This is also called the As You Like It option. The chooser option is discussed in Hull, [37] pages 4612. Consider European call and put options both expiring at T = 1. A chooser option involves three dates, t = 0, t = S, and t = T > S. At t = 0) you purchase the chooser option which gives you the right to either a European put option or a European call option at t = S, both of which expire (with the same strike price) at t=T. To value the chooser option, we first compute P(S, j) and C(S, j), the put and call prices at t = S, then set W(S,j) = max [P(S, j), C(S, j)]. Then compute W(0,0) by usual backwardization. Use the same data as above with K = 90 and S = 0.5 (n = 5) and o = 20% to evaluate the chooser option. Exercise 4.12 (The chooser option). This is also called the As You Like It option. The chooser option is discussed in Hull, [37] pages 4612. Consider European call and put options both expiring at T = 1. A chooser option involves three dates, t = 0, t = S, and t = T > S. At t = 0) you purchase the chooser option which gives you the right to either a European put option or a European call option at t = S, both of which expire (with the same strike price) at t=T. To value the chooser option, we first compute P(S, j) and C(S, j), the put and call prices at t = S, then set W(S,j) = max [P(S, j), C(S, j)]. Then compute W(0,0) by usual backwardization. Use the same data as above with K = 90 and S = 0.5 (n = 5) and o = 20% to evaluate the chooser option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts