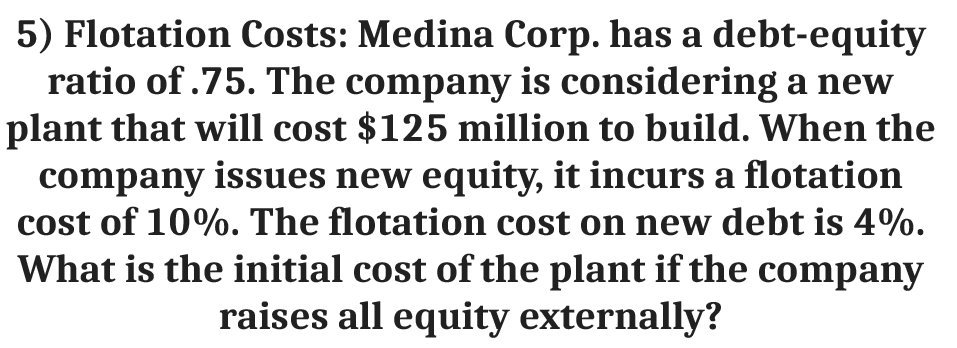

Question: 5 ) Flotation Costs : Medina Corp . has a debt- equity ratio of 75 . The company is considering a new plant that will

5 ) Flotation Costs : Medina Corp . has a debt- equity ratio of 75 . The company is considering a new plant that will cost $ 125 million to build . When the company issues new equity , it incurs a flotation cost of 10% . The flotation cost on new debt is 4 % What is the initial cost of the plant if the company raises all equity externally

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts