Question: (5) Given the table in question (2), are the call options in the money or out of the money? What is the intrinsi value of

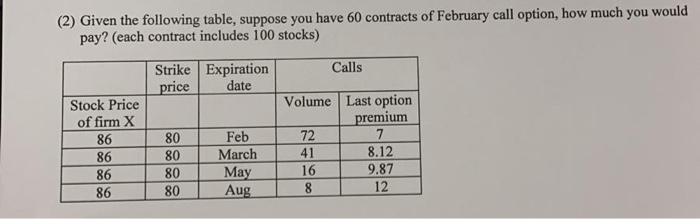

(5) Given the table in question (2), are the call options in the money or out of the money? What is the intrinsi value of the call option of firm X? (2) Given the following table, suppose you have 60 contracts of February call option, how much you would pay? (each contract includes 100 stocks) Calls Strike Expiration date price Volume Last option premium Stock Price of firm X Feb March May Aug 72 80 86 8.12 41 80 86 9.87 16 80 86 12 80 86

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts