Question: 5. Hector Enterprises (PLEASE DO NOT USE EXCEL. SHOW ALL WORK BY HAND) Hector Enterprises is currently financed with all equity, and its cost of

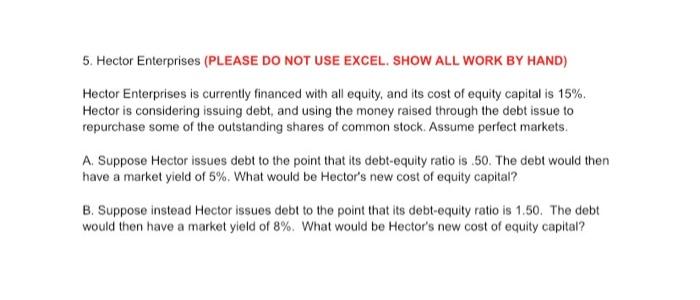

5. Hector Enterprises (PLEASE DO NOT USE EXCEL. SHOW ALL WORK BY HAND) Hector Enterprises is currently financed with all equity, and its cost of equity capital is 15% Hector is considering issuing debt, and using the money raised through the debt issue to repurchase some of the outstanding shares of common stock. Assume perfect markets. A. Suppose Hector issues debt to the point that its debt-equity ratio is.50. The debt would then have a market yield of 5%. What would be Hector's new cost of equity capital? B. Suppose instead Hector issues debt to the point that its debt-equity ratio is 1.50. The debt would then have a market yield of 8%. What would be Hector's new cost of equity capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts