Question: 5. Howard Weiss, Inc., is considering building a sensitive new radiation scanning device. His managers believe that there is a probability of 0.35 that the

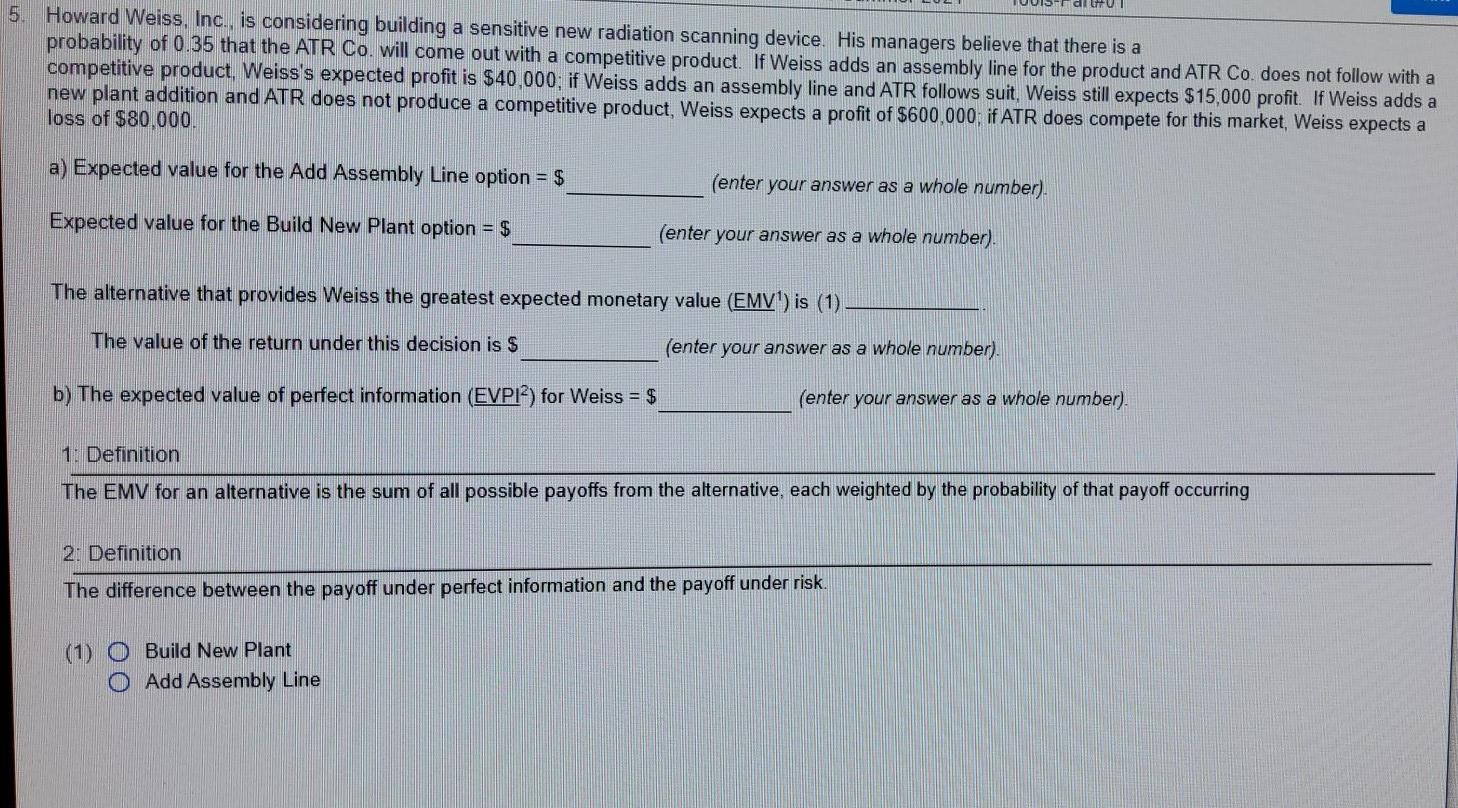

5. Howard Weiss, Inc., is considering building a sensitive new radiation scanning device. His managers believe that there is a probability of 0.35 that the ATR Co. will come out with a competitive product. If Weiss adds an assembly line for the product and ATR Co does not follow with a competitive product, Weiss's expected profit is $40,000; if Weiss adds an assembly line and ATR follows suit, Weiss still expects $15,000 profit. If Weiss adds a new plant addition and ATR does not produce a competitive product, Weiss expects a profit of $600,000; if ATR does compete for this market, Weiss expects a loss of $80,000. a) Expected value for the Add Assembly Line option = $ (enter your answer as a whole number) Expected value for the Build New Plant option = $ (enter your answer as a whole number). The alternative that provides Weiss the greatest expected monetary value (EMV') is (1) The value of the return under this decision is $ (enter your answer as a whole number). b) The expected value of perfect information (EVPI) for Weiss = $ (enter your answer as a whole number). 1. Definition The EMV for an alternative is the sum of all possible payoffs from the alternative, each weighted by the probability of that payoff occurring 2. Definition The difference between the payoff under perfect information and the payoff under risk. (1) Build New Plant 0 Add Assembly Line

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock