Question: . $ % 5 in recovered workbooks? Your recent changes were saved. Do you want to continue working where y Xfc Long Answer - Question

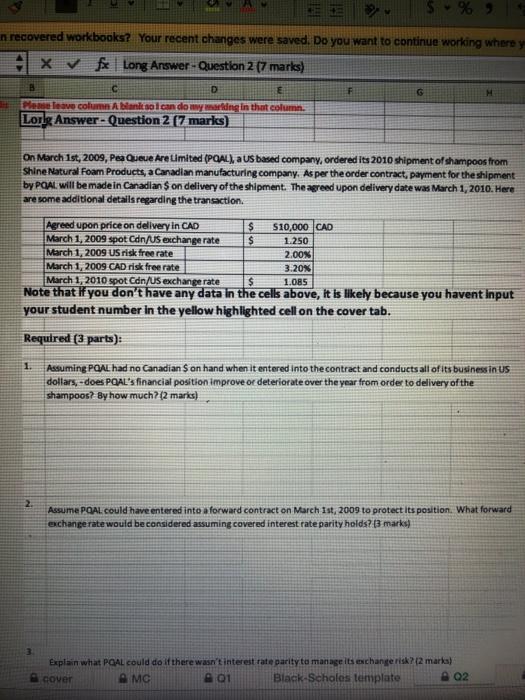

. $ % 5 in recovered workbooks? Your recent changes were saved. Do you want to continue working where y Xfc Long Answer - Question 2 [7 marks) B D E El Teave column A bank sal can do wysing in that column. Lorg Answer - Question 2 [7 marks) On March 1st, 2009, Pea Queue Are Limited (PAL), a US based company, ordered its 2010 shipment of shampoos from Shine Natural Foam Products, a Canadian manufacturing company. As per the order contract, payment for the shipment by POAI will be made in Canadian Son delivery of the shipment. The agreed upon delivery date was March 1, 2010. Here are some additional details regarding the transaction. Agreed upon price on delivery in CAD $ $10,000 CAD March 1, 2009 spot Conds exchange rate $ 1.250 March 1, 2009 US risk free rate 2.00% March 1, 2009 CAD risk free rate 3.20% March 1, 2010 spot Can/US exchange rate $ 1.085 Note that if you don't have any data in the cells above, It is likely because you havent Input your student number in the yellow highlighted cell on the cover tab. Required (3 parts): 1. Assuming PQAL had no Canadian S on hand when it entered into the contract and conducts all of its business in us dollars, - does PQAL's financial position improve or deteriorate over the year from order to delivery of the shampoos? By how much? (2 marks) 2. Assume POAL could have entered into a forward contract on March 1st, 2009 to protect its position. What forward exchange rate would be considered assuming covered interest rate parity holds? (3 mark) Explain what PGAL could do it there wasn't interest rate parity to manage its exchange risk?[2 marka) cover AMC A01 Black-Scholas template 02

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts