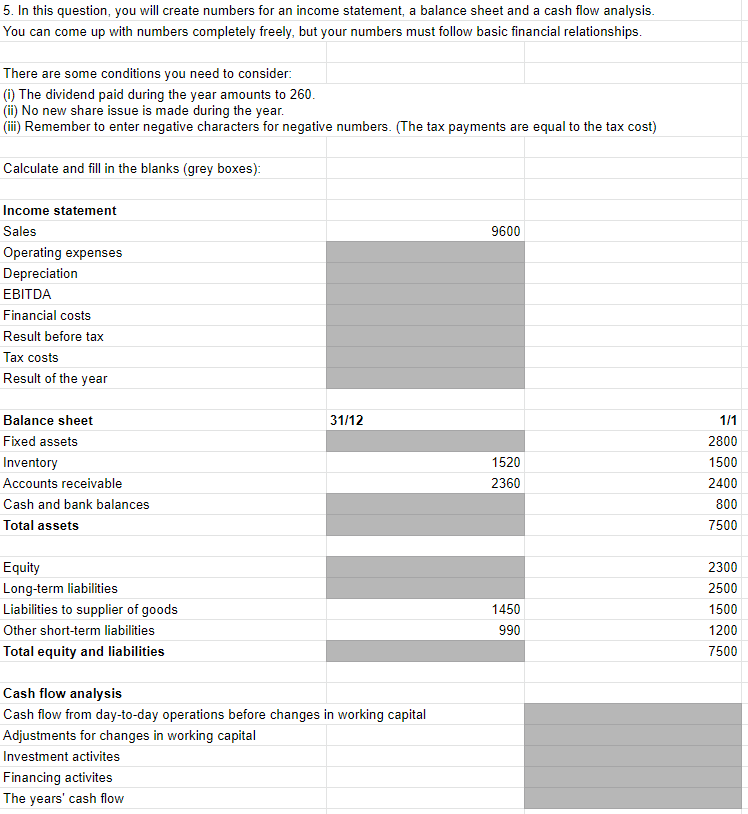

Question: 5. In this question, you will create numbers for an income statement, a balance sheet and a cash flow analysis. You can come up

5. In this question, you will create numbers for an income statement, a balance sheet and a cash flow analysis. You can come up with numbers completely freely, but your numbers must follow basic financial relationships. There are some conditions you need to consider: (1) The dividend paid during the year amounts to 260. (ii) No new share issue is made during the year. (ii) Remember to enter negative characters for negative numbers. (The tax payments are equal to the tax cost) Calculate and fill in the blanks (grey boxes): Income statement Sales 9600 Operating expenses Depreciation EBITDA Financial costs Result before tax Tax costs Result of the year Balance sheet 31/12 1/1 Fixed assets 2800 Inventory 1520 1500 Accounts receivable 2360 2400 Cash and bank balances 800 Total assets 7500 Equity 2300 Long-term liabilities 2500 Liabilities to supplier of goods 1450 1500 Other short-term liabilities 990 1200 Total equity and liabilities 7500 Cash flow analysis Cash flow from day-to-day operations before changes in working capital Adjustments for changes in working capital Investment activites Financing activites The years' cash flow

Step by Step Solution

3.32 Rating (155 Votes )

There are 3 Steps involved in it

income statement sales 9600 operating expense 4160 depreciation 150 EBITDA 5290 Financial costs 1710 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

625e512c742e3_book12333.xlsx

300 KBs Excel File