Question: 5. Long Question 5 ( 18 points, 6 points each) The current market price of one Airbus stock is $600. The last dividend of Airbus

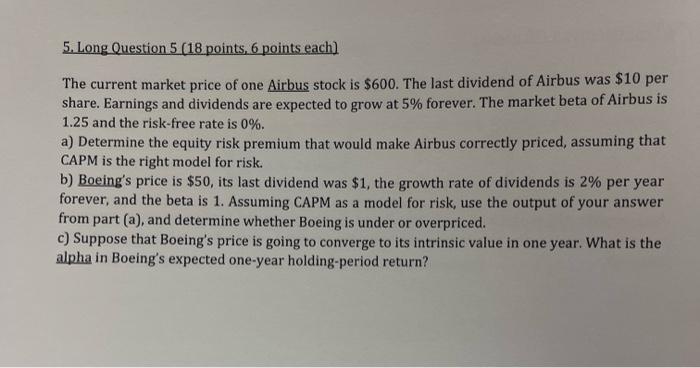

5. Long Question 5 ( 18 points, 6 points each) The current market price of one Airbus stock is $600. The last dividend of Airbus was $10 per share. Earnings and dividends are expected to grow at 5% forever. The market beta of Airbus is 1.25 and the risk-free rate is 0%. a) Determine the equity risk premium that would make Airbus correctly priced, assuming that CAPM is the right model for risk. b) Boeing's price is $50, its last dividend was $1, the growth rate of dividends is 2% per year forever, and the beta is 1 . Assuming CAPM as a model for risk, use the output of your answer from part (a), and determine whether Boeing is under or overpriced. c) Suppose that Boeing's price is going to converge to its intrinsic value in one year. What is the alpha in Boeing's expected one-year holding-period return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts