Question: (5 marks) (5 marks) a) Calculate the expected returns for Stock X, Stock Y b) Calculate the standard deviation for each Stock c) From Risk-Return

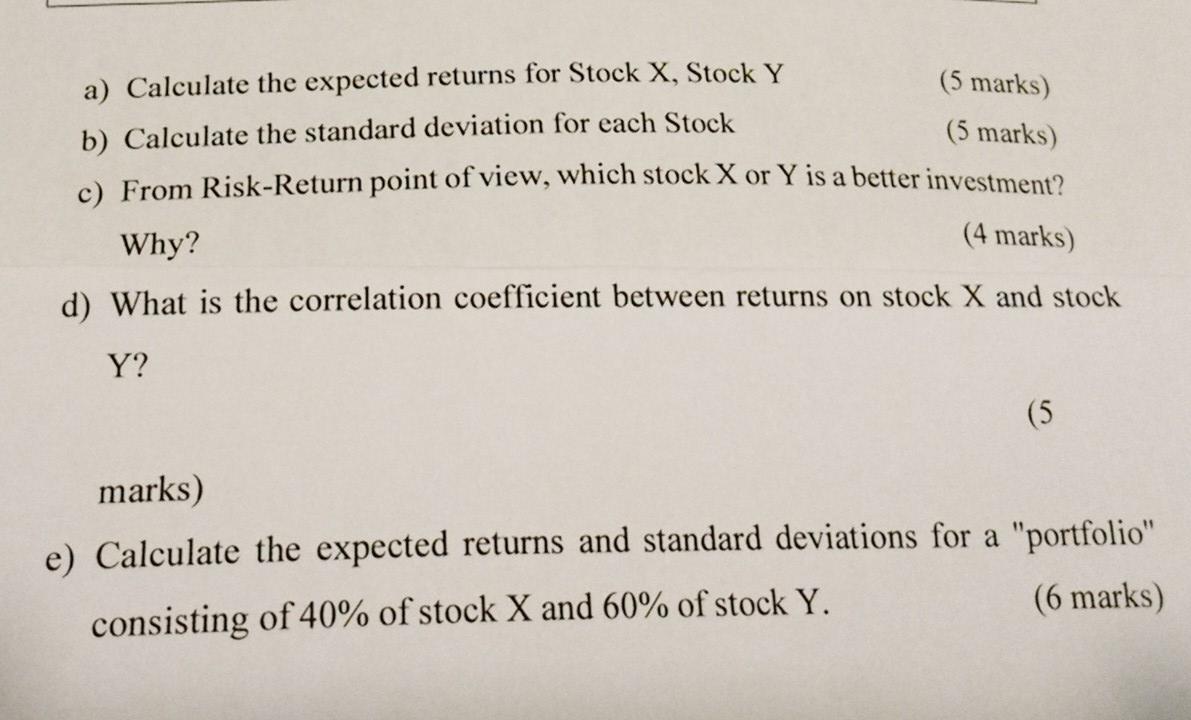

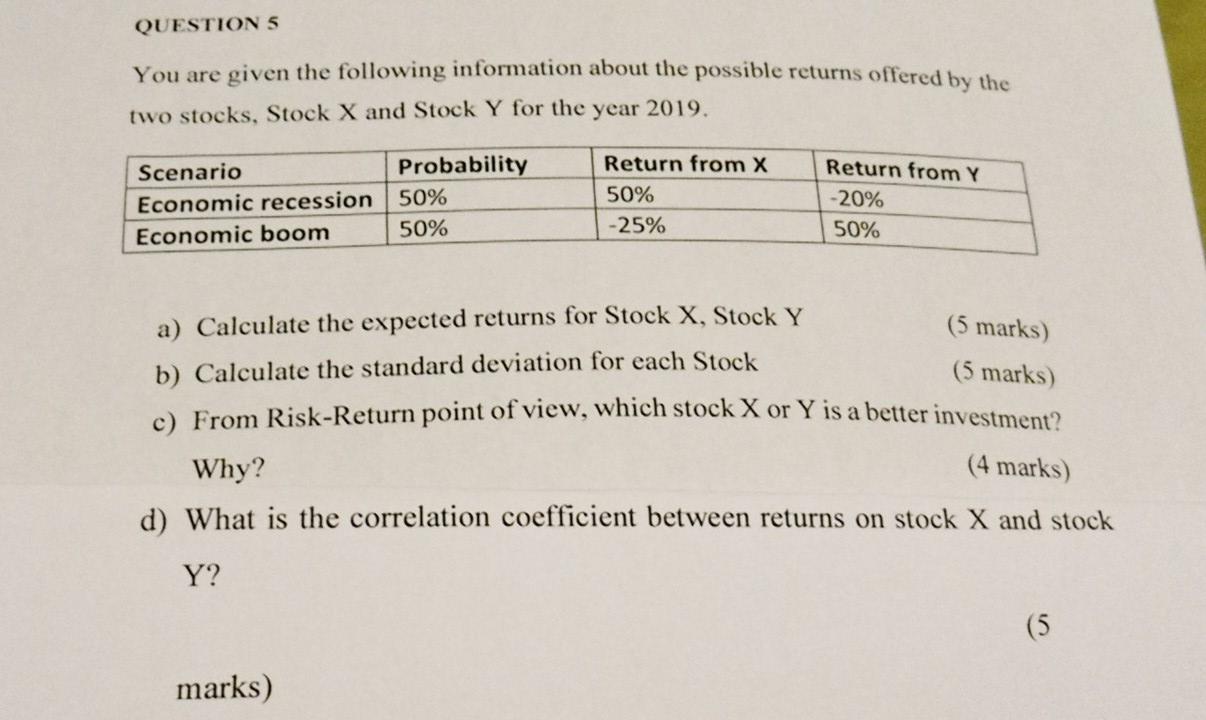

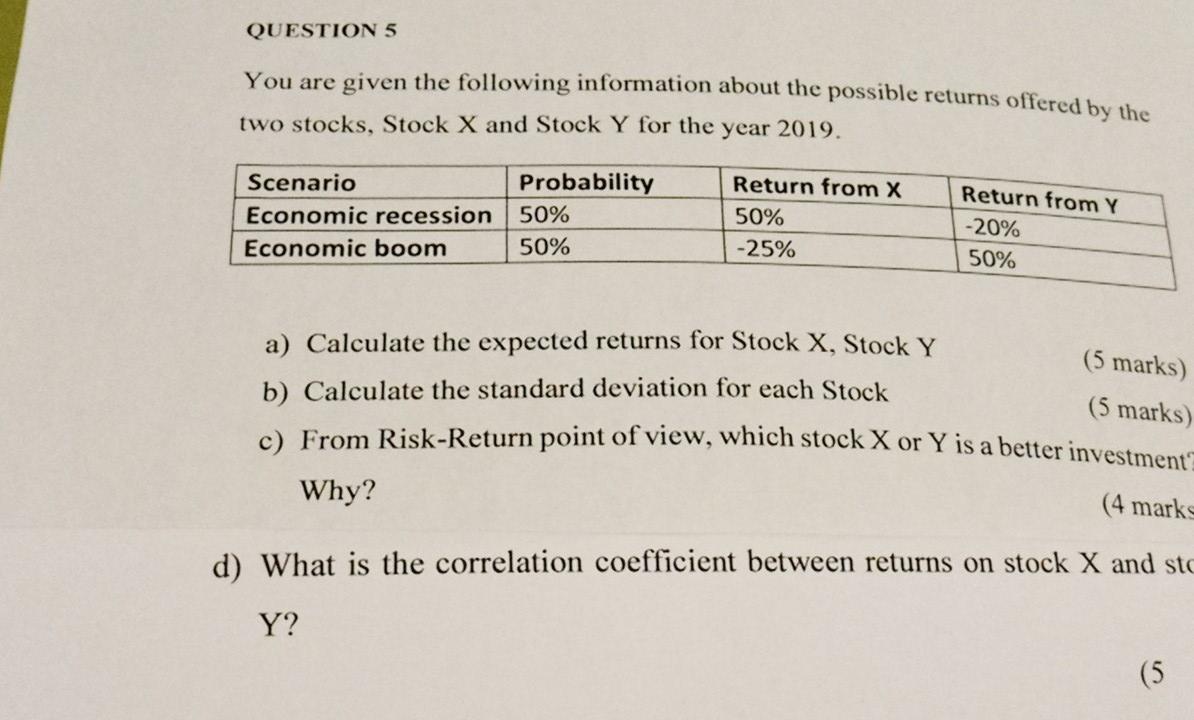

(5 marks) (5 marks) a) Calculate the expected returns for Stock X, Stock Y b) Calculate the standard deviation for each Stock c) From Risk-Return point of view, which stock X or Y is a better investment? Why? (4 marks) d) What is the correlation coefficient between returns on stock X and stock Y? (5 marks) e) Calculate the expected returns and standard deviations for a "portfolio" consisting of 40% of stock X and 60% of stock Y. (6 marks) QUESTIONS You are given the following information about the possible returns offered by the two stocks, Stock X and Stock Y for the year 2019. Scenario Economic recession Economic boom Probability 50% 50% Return from X 50% -25% Return from Y -20% 50% (5 marks) (5 marks) a) Calculate the expected returns for Stock X, Stock Y b) Calculate the standard deviation for each Stock c) From Risk-Return point of view, which stock X or Y is a better investment? Why? (4 marks) d) What is the correlation coefficient between returns on stock X and stock Y? marks) QUESTION 5 You are given the following information about the possible returns offered by the two stocks, Stock X and Stock Y for the year 2019. Scenario Economic recession Economic boom Probability 50% 50% Return from X 50% -25% Return from Y -20% 50% a) Calculate the expected returns for Stock X, Stock Y b) Calculate the standard deviation for each Stock c) From Risk-Return point of view, which stock X or Y is a better investment Why? (5 marks) (5 marks) (4 marks d) What is the correlation coefficient between returns on stock X and sta Y? (5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts