Question: 5. Measuring standalone risk using realized (historical) data Returns eamed over a given time period are called realized returns. Historical data on realed returns is

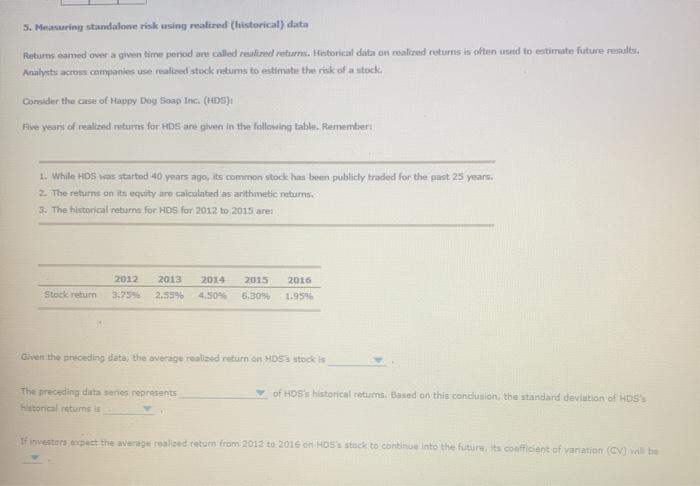

5. Measuring standalone risk using realized (historical) data Returns eamed over a given time period are called realized returns. Historical data on realed returns is often used to estimate future results. Analysts across companies se realised stock returns to estimate the risk of a stock. Consider the case of Happy Dog Soap Inc. (HS) Five years of realized returnes for HDS are given in the fallowing table. Remember 1. While HDS as started 40 years ago, its common stock has been publicly traded for the past 25 years. 2. The returns on its equity are calculated as arithmetic returns 3. The historical returns for HDS for 2012 to 2015 ares 2012 2013 2016 2014 4.50 2015 6.309 Stock return 3759 2.559 1.959 Guen the preceding data, the average realized return on HDSS stocks The preceding data sees represents historical returns is of HDS's historical returns. Based on this conclusion, the standard deviation of HDS'S If investors expect the average coalised return from 2012 to 2016 on HDS's stock to continue into the future to conficient of variation (CV) will be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts