Question: i need help to understand this question. if you explain it step by step on papper D E F H 1. 206 (20 points) 3

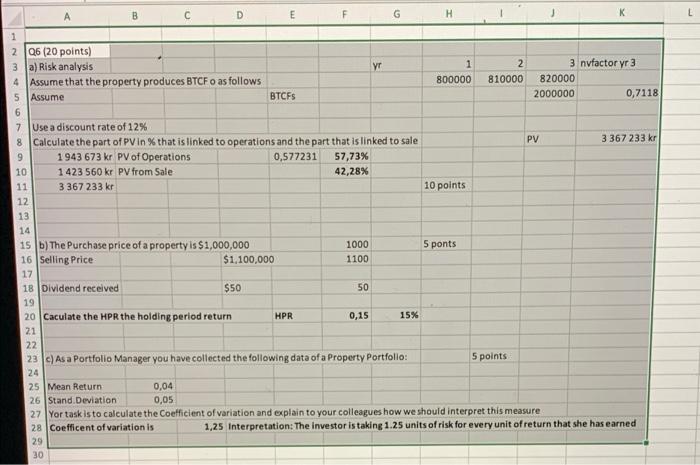

D E F H 1. 206 (20 points) 3 a) Risk analysis yr 1 2 3 nyfactor yr 3 4 Assume that the property produces BTCF o as follows 800000 810000 820000 5 Assume BTCFS 2000000 0,7118 6 7 Use a discount rate of 12% 8 Calculate the part of PV in % that is linked to operations and the part that is linked to sale PV 3 367 233 kr 9 1943 673 kr PV of Operations 0,577231 57,73% 10 1423 560 kr PV from Sale 42,28% 11 3 367 233 kr 10 points 12 13 14 15 b) The Purchase price of a property is $1,000,000 1000 5 ponts 16 Selling Price $1,100,000 1100 17 18 Dividend received $50 50 19 20 Caculate the HPR the holding period return HPR 0,15 15% 21 22 23 )As a Portfolio Manager you have collected the following data of a Property Portfolio: 5 points 24 25 Mean Return 0,04 26 Stand. Deviation 0,05 27 Yor taskisto calculate the Coefficient of variation and explain to your colleagues how we should interpret this measure 28 Coefficent of variation is 1.25 Interpretation: The investor is taking 1.25 units of risk for every unit of return that she has earned 29 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts