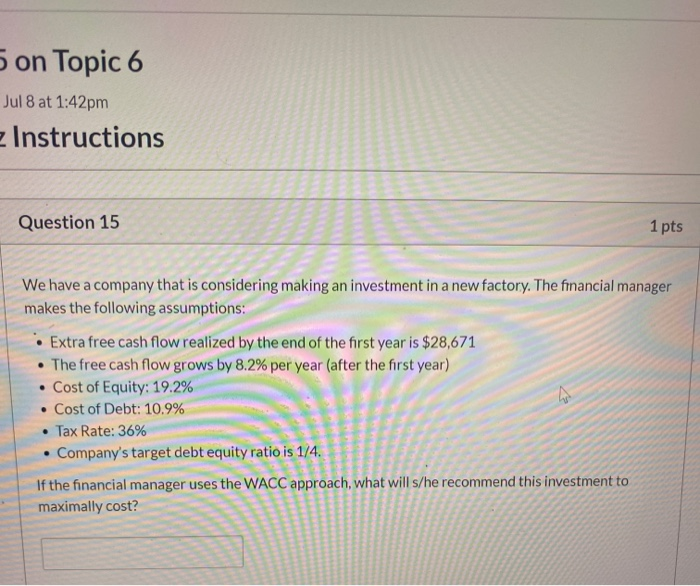

Question: 5 on Topic 6 Jul 8 at 1:42pm Instructions Question 15 1 pts We have a company that is considering making an investment in a

5 on Topic 6 Jul 8 at 1:42pm Instructions Question 15 1 pts We have a company that is considering making an investment in a new factory. The financial manager makes the following assumptions: Extra free cash flow realized by the end of the first year is $28,671 The free cash flow grows by 8.2% per year (after the first year) Cost of Equity: 19.2% Cost of Debt: 10.9% Tax Rate: 36% Company's target debt equity ratio is 1/4. If the financial manager uses the WACC approach, what will s/he recommend this investment to maximally cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts