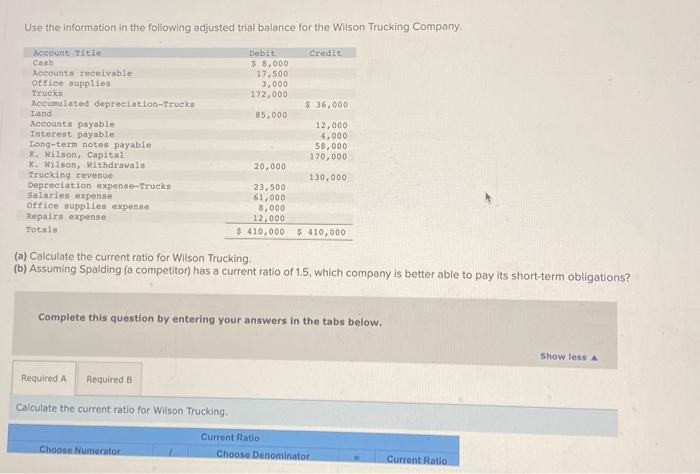

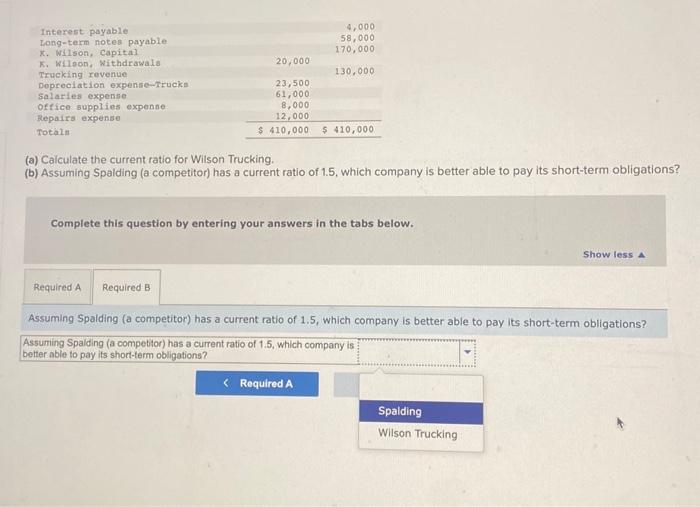

Question: 5. please help (a) Calculate the current ratio for Wilson Trucking. (b) Assuming Spalding (a competitor) has a current ratio of 1.5 , which company

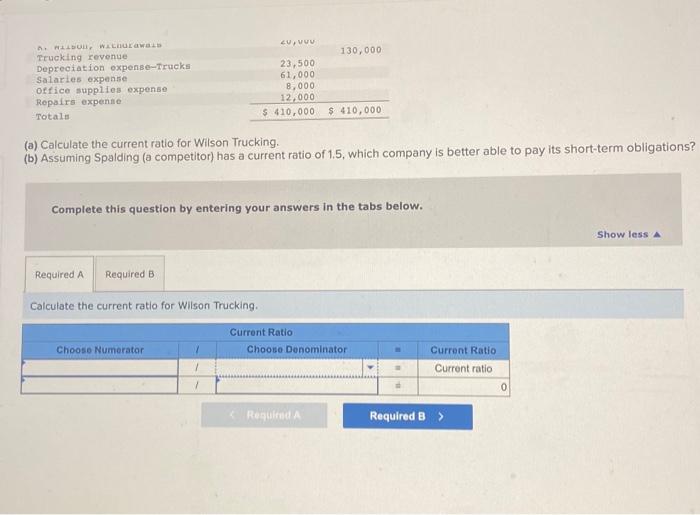

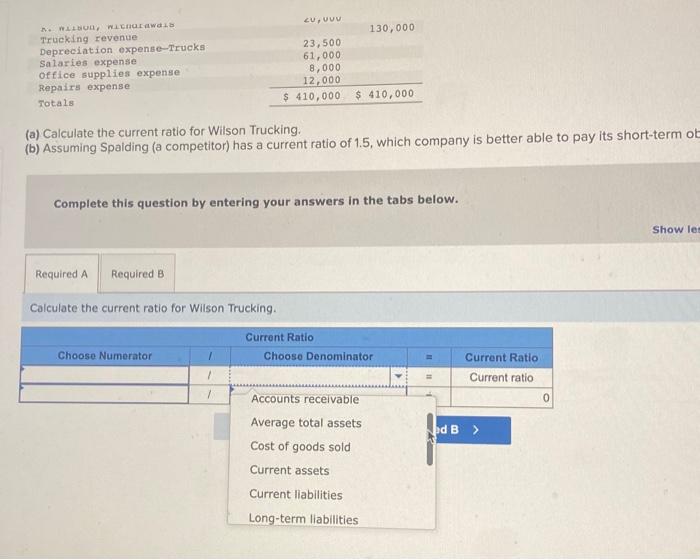

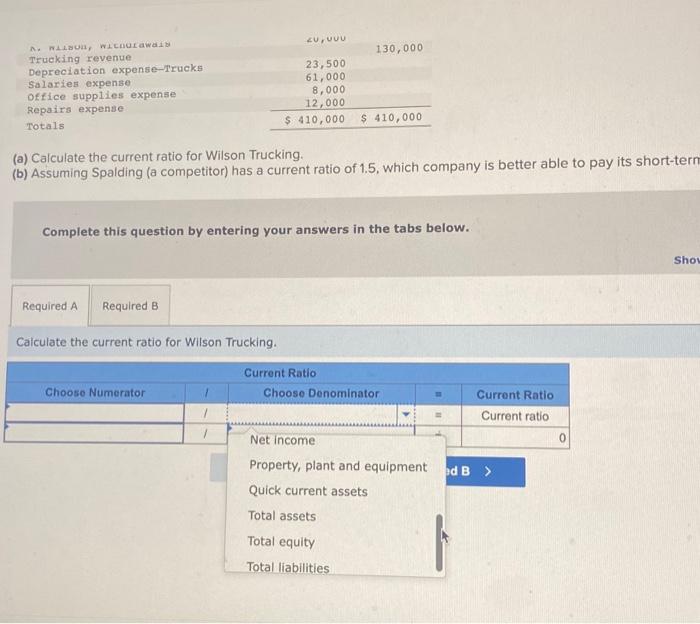

(a) Calculate the current ratio for Wilson Trucking. (b) Assuming Spalding (a competitor) has a current ratio of 1.5 , which company is better able to pay its short-term obligations? Complete this question by entering your answers in the tabs below. Show less Calculate the current ratio for Wilson Trucking. (a) Calculate the current ratio for Wilson Trucking. (b) Assuming Spalding (a competitor) has a current ratio of 1.5, which company is better able to pay its short-tern Complete this question by entering your answers in the tabs below. Caiculate the current ratio for Wilson Trucking. Use the information in the following adjusted trial balance for the Wilson Trucking Company. (a) Calculate the current ratio for Wilson Trucking. (b) Assuming Spalding (a competitor) has a current ratio of 1.5 , which company is better able to pay its short-term obligations? Complete this question by entering your answers in the tabs below. Calculate the current ratio for Wilson Trucking. (a) Calculate the current ratio for Wilson Trucking. (b) Assuming Spalding (a competitor) has a current ratio of 1.5 , which company is better able to pay its short-term obligations? Complete this question by entering your answers in the tabs below. Show less A Assuming Spalding (a competitor) has a current ratio of 1.5, which company is better able to pay its short-term obligations? Assuming Spalding (a competior) has a current ratio of 1.5, which company is better able to pay its short-term obligations? (a) Calculate the current ratio for Wilson Trucking. (b) Assuming Spaiding (a competitor) has a current ratio of 1.5, which company is better able to pay its short-term o Complete this question by entering your answers in the tabs below. Calculate the current ratio for Wilson Trucking

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts