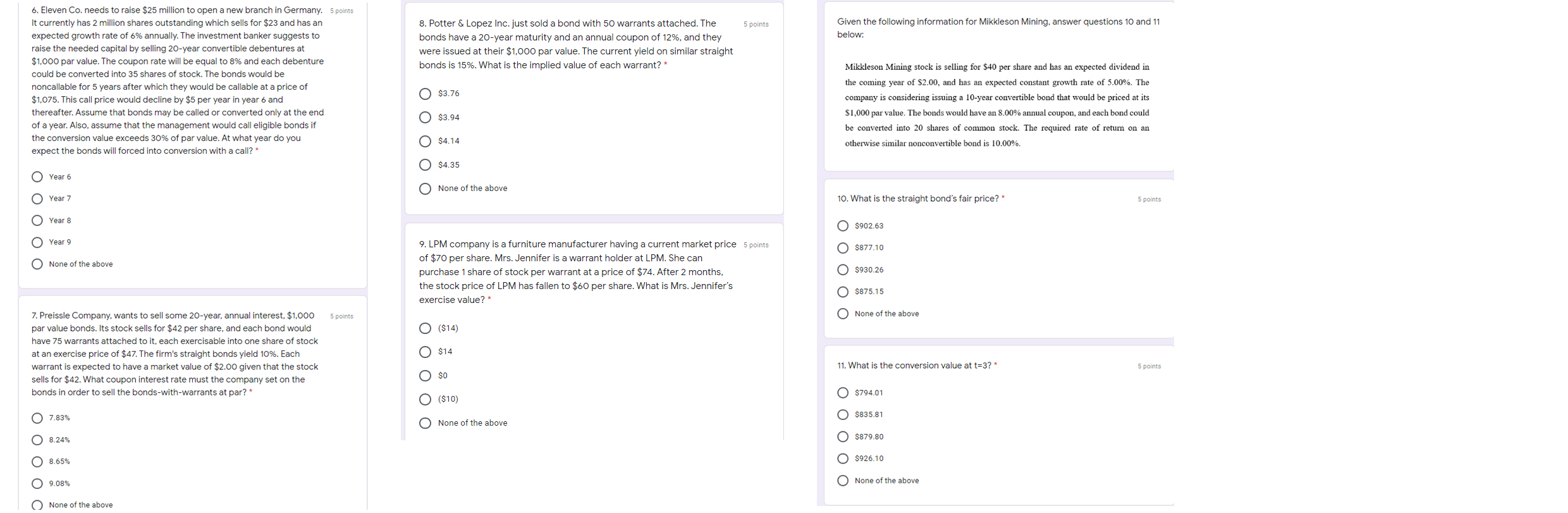

Question: 5 points Given the following information for Mikkleson Mining, answer questions 10 and 11 below: 8. Potter & Lopez Inc. just sold a bond with

5 points Given the following information for Mikkleson Mining, answer questions 10 and 11 below: 8. Potter & Lopez Inc. just sold a bond with 50 warrants attached. The bonds have a 20-year maturity and an annual coupon of 12%, and they were issued at their $1,000 par value. The current yield on similar straight bonds is 15%. What is the implied value of each warrant? * 6. Eleven Co. needs to raise $25 million to open a new branch in Germany. 5 points It currently has 2 million shares outstanding which sells for $23 and has an expected growth rate of 6% annually. The investment banker suggests to raise the needed capital by selling 20-year convertible debentures at $1.000 par value. The coupon rate will be equal to 8% and each debenture could be converted into 35 shares of stock. The bonds would be noncallable for 5 years after which they would be callable at a price of $1,075. This call price would decline by $5 per year in year 6 and thereafter. Assume that bonds may be called or converted only at the end of a year. Also, assume that the management would call eligible bonds if the conversion value exceeds 30% of par value. At what year do you expect the bonds will forced into conversion with a call?* O $3.76 Mikkleson Mining stock is selling for $40 per share and has an expected dividend in the coming year of $2.00, and has an expected constant growth rate of 5.00%. The company considering issuing a 10-year convertible bond that would be priced at its $1,000 par value. The bonds would have an 8.00% annual coupon, and each bond could be converted into 20 shares of common stock. The required rate of return on an otherwise similar nonconvertible bond is 10.00%. $3.94 O $4.14 O O O O O $4.35 O Year 6 O None of the above Year 7 10. What is the straight bond's fair price? * 5 points O Year 8 $902.63 O Year 9 $877.10 O None of the above 9. LPM company is a furniture manufacturer having a current market price 5 points of $70 per share. Mrs. Jennifer is a warrant holder at LPM. She can purchase 1 share of stock per warrant at a price of $74. After 2 months, the stock price of LPM has fallen to $60 per share. What is Mrs. Jennifer's exercise value? O O d O $930.26 O $875.15 5 points None of the above O ($14) 7. Preissle Company, wants to sell some 20-year, annual interest, $1.000 par value bonds. Its stock sells for $42 per share, and each bond would have 75 warrants attached to it, each exercisable into one share of stock at an exercise price of $47. The firm's straight bonds yield 10%. Each warrant is expected to have a market value of $2.00 given that the stock sells for $42. What coupon interest rate must the company set on the bonds in order to sell the bonds-with-warrants at par?* O $14 11. What is the conversion value at t=3?* 5 points O SO $794.01 O ($10) O $835.81 0 7.83% O None of the above O 8.24% $879.80 O O O O O 8.65% O O O $926.10 9.08% O None of the above O None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts