Question: 5 points Manama Inc. is considering two mutually exclusive projects A and B. The initial investment and the estimates of the annual revenues and cost

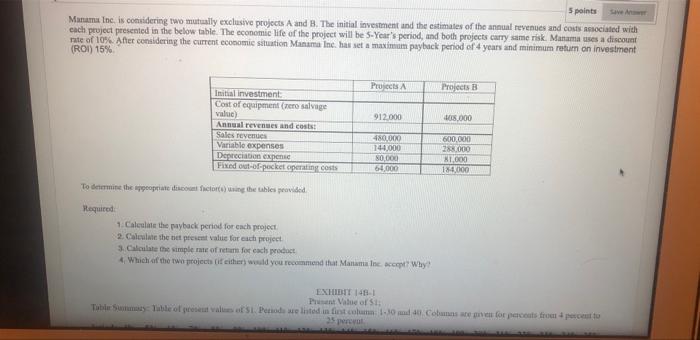

5 points Manama Inc. is considering two mutually exclusive projects A and B. The initial investment and the estimates of the annual revenues and cost sociated with each project presented in the below table. The economic life of the project will be 5-Year's period, and both projects carry same risk. Manama uses a discount rate of 10% After considering the current economie situation Manama Inc. has set a maximum payback period of 4 years and minimum return on investment (ROI) 15% Pej Projects 912.000 108.000 Initial Investment Cost of equipment Cero salvage value Annual revenues and costs Sales revenues Variable expenses Depreciation expense Fixed out-of-pocket operating costs 480.000 144,000 N0.000 64000 600.000 288.000 1.000 10000 To determine the people coloring the tables provided Required 1. Calculate the payback period for each project 2. Calculate the net present value for each project 3. Calculate the simple rate of car for each product 4 Which of the two projects it either would you recommend that Manama Ine. cept? Why? EXHIBIT 14 Print Value of 5 Table Summe Table on value of St. Periode we listed in first column 1.100 Cobum te for parents from pecetto 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts