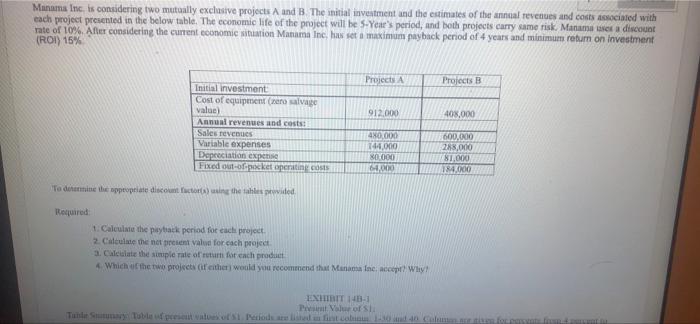

Question: Munams Inc. is considering two mutually exclusive projects A and B The initial investment and the estimates of the annual revenues and costs associated with

Munams Inc. is considering two mutually exclusive projects A and B The initial investment and the estimates of the annual revenues and costs associated with cach project presented in the below table. The economic life of the project will be 5-Year's period, and both projects carry same risk. Manamasse a discount rate of 10% After considering the current conomic situation Manama Inchas set a maximum payback period of 4 years and minimum return on investment (ROI) 15% Projects Projects B 912.000 408.000 Initial investment Cost of equipment (zero salvage value) Annual revenues and costs Sales ventes Variable expenses Depreciation expertise Fixed out-of-pocket operating costs 40.000 144,000 80 000 64.000 600.000 288,000 81,000 184.000 Todennie the appropriate discount cting the sales pied Required 1. Calculate the playback period for each project 2. Calculate the present value for each project 3. Calculate the imple tale of thifor each product 4 Which the two projets af either would you recommend that Mana Inc, accept? Why EXHIBIT 140-1 Profi Try Toblem atost Perodua hal it coin calon

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts