Question: 5 points Save Amer QUESTION 26 Kale Inc. forecasts the free cash flows (in millions) shown below. If the weighted average cost of capital is

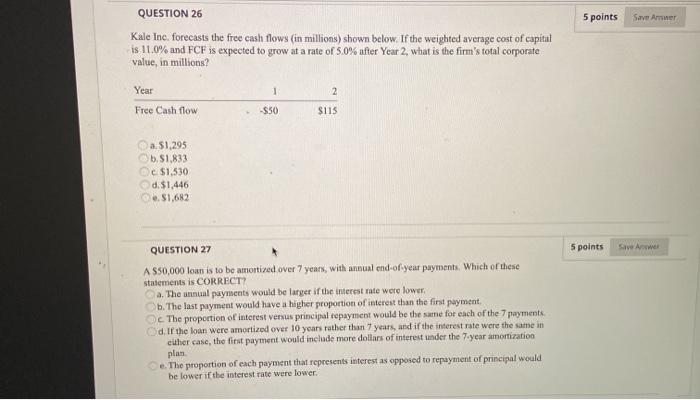

5 points Save Amer QUESTION 26 Kale Inc. forecasts the free cash flows (in millions) shown below. If the weighted average cost of capital is 11.0% and FCF is expected to grow at a rate of 5.0% after Year 2, what is the firm's total corporate value, in millions? Year 2 Free Cash flow $50 SIIS a $1.295 b. $1,833 $1,530 d. $1.446 6.81,682 QUESTION 27 5 points Save Awww A $50,000 loan is to be amortized over 7 years, with annual end of year payments. Which of these statements is CORRECT? a. The annual payments would be larger if the interest rate were lower b. The last payment would have a higher proportion of interest than the first payment c The proportion of interest versus principal repayment would be the same for each of the payments Cd. If the loan were amortized over 10 years rather than 7 years, and if the interest rate were the same in eher case, the first payment would include more dollars of interest under the 7.year amortization plan e. The proportion of each payment that represents interest as opposed to repayment of principal would be lower if the interest rate were lower

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts