Question: please help answer all questions and exactly how you got that answer please Told P . 8 (01-04! 1 point each, U5:4 points each) 1.

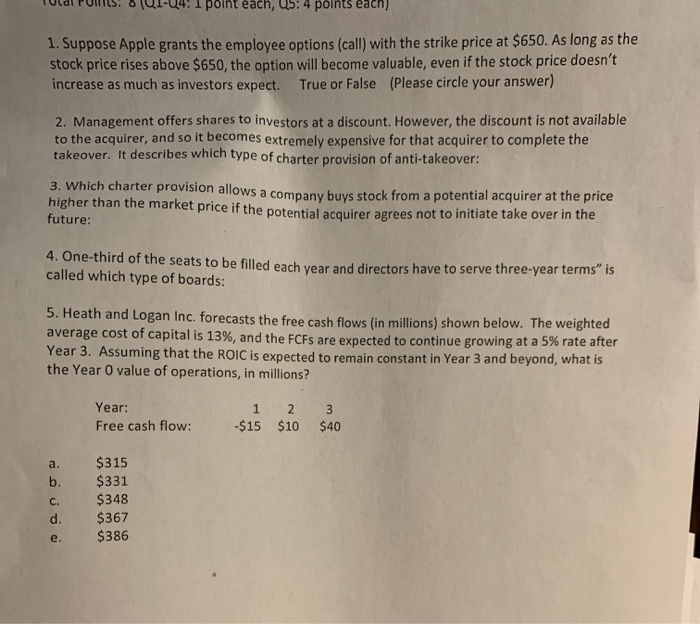

Told P . 8 (01-04! 1 point each, U5:4 points each) 1. Suppose Apple grants the employee options (call) with the strike price at $650. As long as the stock price rises above $650, the option will become valuable, even if the stock price doesn't increase as much as investors expect. True or False (Please circle your answer) 2. Management offers shares to investors at a discount. However, the discount is not available to the acquirer, and so it becomes extremely expensive for that acquirer to complete the takeover. It describes which type of charter provision of anti-takeover: 3. Which charter provision allows a company have stack from a potential acquirer at the price higher than the market price if the potential acquirer agrees not to initiate take over in the future: 4. One-third of the seats to be filled each year and directors have to serve three-year terms" is called which type of boards: 5. Heath and Logan Inc. forecasts the free cash flows (in millions) shown below. The weighted average cost of capital is 13%, and the FCFs are expected to continue growing at a 5% rate after Year 3. Assuming that the ROIC is expected to remain constant in Year 3 and beyond, what is the Year 0 value of operations, in millions? Year: Free cash flow: 1 -$15 2 $10 3 $40 $315 $331 $348 $367 $386

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts