Question: 5 points Save Answer Thomson Media is considering a new three-year project whose data are shown below. In particular, the project requires an initial fixed

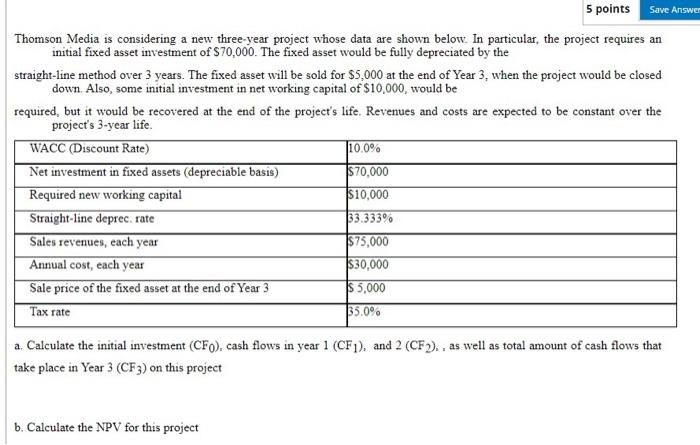

5 points Save Answer Thomson Media is considering a new three-year project whose data are shown below. In particular, the project requires an initial fixed asset investment of $70,000. The fixed asset would be fully depreciated by the straight-line method over 3 years. The fixed asset will be sold for $5,000 at the end of Year 3, when the project would be closed down. Also, some initial investment in net working capital of $10,000, would be required, but it would be recovered at the end of the project's life. Revenues and costs are expected to be constant over the project's 3-year life WACC (Discount Rate) 10.0% Net investment in fixed assets (depreciable basis) $70,000 Required new working capital $10,000 Straight-line deprec. rate 33.333% Sales revenues, each year $75,000 Annual cost, each year $30,000 Sale price of the fixed asset at the end of Year 3 $5,000 Tax rate 135.0% a. Calculate the initial investment (CFO). cash flows in year 1 (CF1), and 2 (CF)., as well as total amount of cash flows that take place in Year 3 (CF3) on this project b. Calculate the NPV for this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts