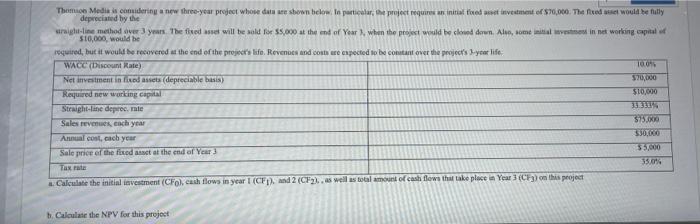

Question: Thomas Medicaidring a new three-year project whose data are shown below. In particular, the project requires an initiative et investment of S70,000. The feeds would

Thomas Medicaidring a new three-year project whose data are shown below. In particular, the project requires an initiative et investment of S70,000. The feeds would be fully depreciated by the straight line method over yours. The fixed asset will be sold for 55.000 at the end of Year, when the project would be closed down. Also, sometimes in networking capital $10,000, would be required, but it would be recovered at the end of the project's life. Revenues and costs are expected to be constant over the project's your life WACC (Discount Kate) 100 Net investment in fixed assets (depreciable basis) 57000 $10.000 Required new working Capital 333 Straight-line deprecate $15.00 Sales reven each year 3000 Annual cost, cach year 55,000 Sale price of the fixed at the end of Year 3 55.0 Tarra Calculate the initial lavestment (CFO) cash flows in year 1 (CF) and 2 (CF2..as well as total amount of cash flows that take place in Year 3 (CE) on this project b. Calculate the NPV for this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts