Question: 5. Pricing: What price would you pay for Bear's ongoing business? Please provide numerical analysis to back up your answers. This could include multiple

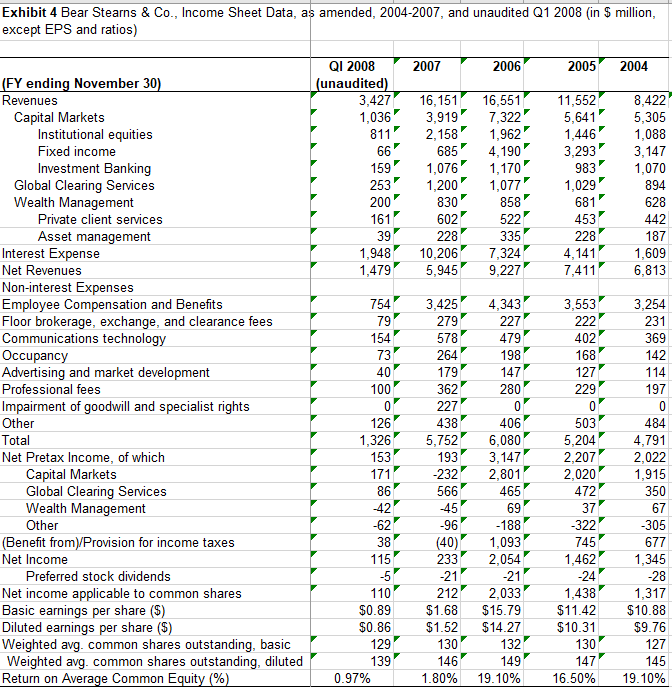

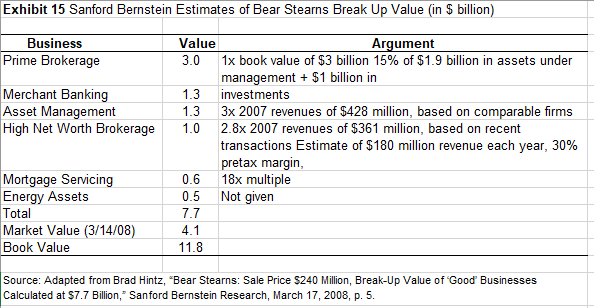

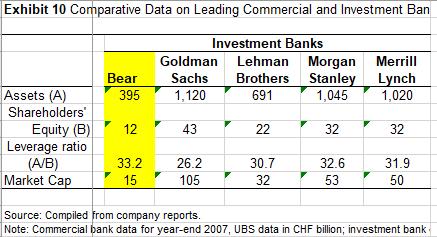

5. Pricing: What price would you pay for Bear's ongoing business? Please provide numerical analysis to back up your answers. This could include multiple methods of valuation that you develop yourself. Exhibit 4 Bear Stearns & Co., Income Sheet Data, as amended, 2004-2007, and unaudited Q1 2008 (in $ million, except EPS and ratios) (FY ending November 30) Revenues Capital Markets Institutional equities Fixed income Investment Banking Global Clearing Services Wealth Management Private client services Asset management Interest Expense Net Revenues Non-interest Expenses Employee Compensation and Benefits Floor brokerage, exchange, and clearance fees Communications technology Occupancy Advertising and market development Professional fees Impairment of goodwill and specialist rights Other Total Net Pretax Income, of which Capital Markets Global Clearing Services Wealth Management Other (Benefit from)/Provision for income taxes Net Income Preferred stock dividends Net income applicable to common shares Basic earnings per share ($) Diluted earnings per share ($) Weighted avg. common shares outstanding, basic Weighted avg. common shares outstanding, diluted Return on Average Common Equity (%) QI 2008 (unaudited) 3,427 1,036 811 66 159 253 200 161 39 1,948 1,479 754 79 154 73 40 100 0 126 1,326 153 2007 0.97% 16,151 16,551 11,552 5,641 1,446 3,293 3,919 7,322 2,158 1,962 685 1,076' 1,200 830 602 228 10,206 5,945 3,425 279 578 264 179 362 2006 227 438 171 86 -42 -62 38 115 -5 110 $0.89 $0.86 $1.52 129 130 139 146 1.80% 4,190 1,170 1,077' 858 522 335 7,324 Sill 9,227 4,343 227 147 280 0 406 5,752 6,080 193 3,147 -232 2,801 566 465 -45 69 -96 -188 (40) 1,093 233 2,054 -21 -21 212 2,033 $1.68 $15.79 $14.27 132 149 19.10% 479 198 2005 983 1,029 681 453 228 4,141 7,411 3,553 222 402 168 127 229 503 5,204 2,207 2,020 472 37 -322 745 1,462 -24 1,438 $11.42 $10.31 130 147 16.50% 2004 8,422 5,305 1,088 3,147 1,070 894 628 442 187 1,609 6,813 3,254 231 369 142 114 197 484 4,791 2,022 1,915 350 67 -305 677 1,345 -28 1,317 $10.88 $9.76 127 145 19.10% Exhibit 15 Sanford Bernstein Estimates of Bear Stearns Break Up Value (in $ billion) Business Value Argument Prime Brokerage 3.0 1x book value of $3 billion 15% of $1.9 billion in assets under management + $1 billion in investments Merchant Banking 1.3 Asset Management 1.3 High Net Worth Brokerage 1.0 Mortgage Servicing Energy Assets Total Market Value (3/14/08) Book Value 0.6 0.5 7.7 4.1 11.8 3x 2007 revenues of $428 million, based on comparable firms 2.8x 2007 revenues of $361 million, based on recent transactions Estimate of $180 million revenue each year, 30% pretax margin, 18x multiple Not given Source: Adapted from Brad Hintz, "Bear Stearns: Sale Price $240 Million, Break-Up Value of 'Good' Businesses Calculated at $7.7 Billion, Sanford Bernstein Research, March 17, 2008, p. 5. Exhibit 10 Comparative Data on Leading Commercial and Investment Ban Assets (A) Shareholders' Equity (B) Leverage ratio (A/B) Market Cap Bear 395 12 33.2 15 Investment Banks Goldman Lehman Morgan Merrill Brothers Stanley Lynch Sachs 1,120 691 1,045 1,020 43 26.2 105 22 30.7 32 32 32.6 53 32 31.9 50 Source: Compiled from company reports. Note: Commercial bank data for year-end 2007, UBS data in CHF billion; investment bank

Step by Step Solution

3.53 Rating (153 Votes )

There are 3 Steps involved in it

To determine the price you would pay for Bears ongoing business you can consider various valuation methods Here are a few methods you can use PricetoE... View full answer

Get step-by-step solutions from verified subject matter experts