VIP-MD is a health maintenance organization (HMO) located in North Carolina. Unlike the traditional fee-for-service model that

Question:

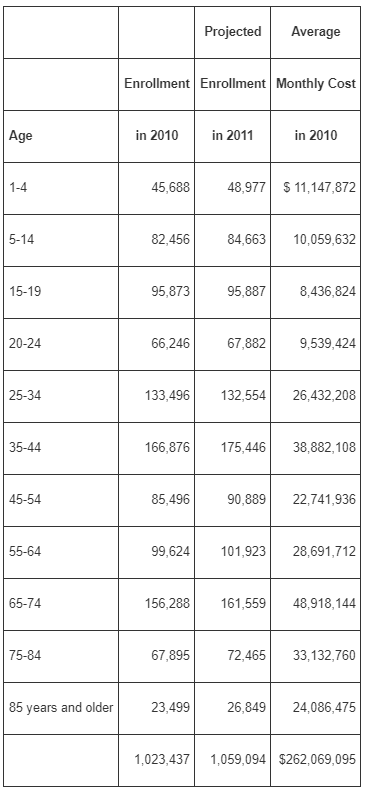

VIP-MD is a health maintenance organization (HMO) located in North Carolina. Unlike the traditional fee-for-service model that determines the payment according to the actual services used or costs incurred, VIP-MD receives a fixed, prepaid amount from subscribers. The per member per month (PMPM) rate is determined by estimating the health care cost per enrollee within a geographic location. The average health care coverage in North Carolina costs $368 per month which is the same amount irrespective of the subscriber’s age. Because individuals are demanding quality care at reasonable rates, VIP-MD must contain its costs to remain competitive. A major competitor, Doctors Nationwide, is entering the North Carolina market in early 2010 with a monthly premium of $325. VIP-MD wants to maintain its current market penetration and hopes to increase its enrollees in 2010. The latest data on the number of enrollees and the associated costs follow:

Required

1. Calculate the target cost required for VIP-MD to maintain its current market share and profit per enrollee in 2010.

2. Costs in the health care industry applicable to VIP-MD and Doctors Nationwide are expected to increase by 6 percent in the coming year, 2011. VIP-MD is planning for the year ahead and is expecting all providers, including VIP-MD and Doctors Nationwide, to increase their rates by $15 to $340. Calculate the new target cost assuming again that VIP-MD wants to maintain the same profit per enrollee as in 2010.

3. Identify the critical success factors for VIP-MD. How can the HMO maintain it’s market share?

Step by Step Answer:

Cost management a strategic approach

ISBN: 978-0073526942

5th edition

Authors: Edward J. Blocher, David E. Stout, Gary Cokins