Question: 5 problem Paragraph 123 Styles 10 11 12 13 14 15 Problem 13 Vortex Technologies Inc. is considering the expansion project that involves the purchase

5 problem

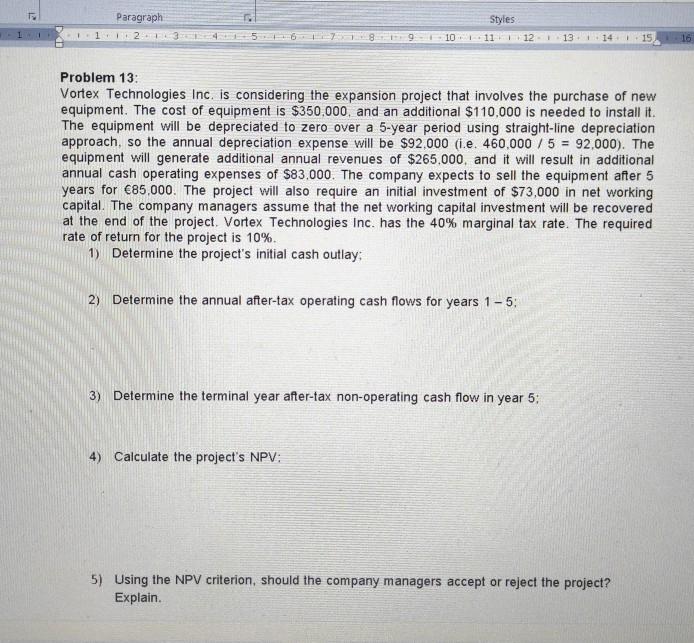

Paragraph 123 Styles 10 11 12 13 14 15 Problem 13 Vortex Technologies Inc. is considering the expansion project that involves the purchase of new equipment. The cost of equipment is $350,000, and an additional $110,000 is needed to install it. The equipment will be depreciated to zero over a 5-year period using straight-line depreciation approach, so the annual depreciation expense will be $92,000 (i.e. 460,000 / 5 = 92,000). The equipment will generate additional annual revenues of $265,000, and it will result in additional annual cash operating expenses of $83.000. The company expects to sell the equipment after 5 years for 85.000. The project will also require an initial investment of $73,000 in net working capital. The company managers assume that the net working capital investment will be recovered at the end of the project. Vortex Technologies Inc. has the 40% marginal tax rate. The required rate of return for the project is 10%. 1 Determine the project's initial cash outlay: 2) Determine the annual after-tax operating cash flows for years 1 - 5 3) Determine the terminal year after-tax non-operating cash flow in year 5: 4) Calculate the project's NPV: 5) Using the NPV criterion, should the company managers accept or reject the project? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts