Question: 5 pts D Question 10 Eagle Industries' bonds have a 10-year maturity and a 8.35% coupon paid semiannually. They sell at their $1,000 par value

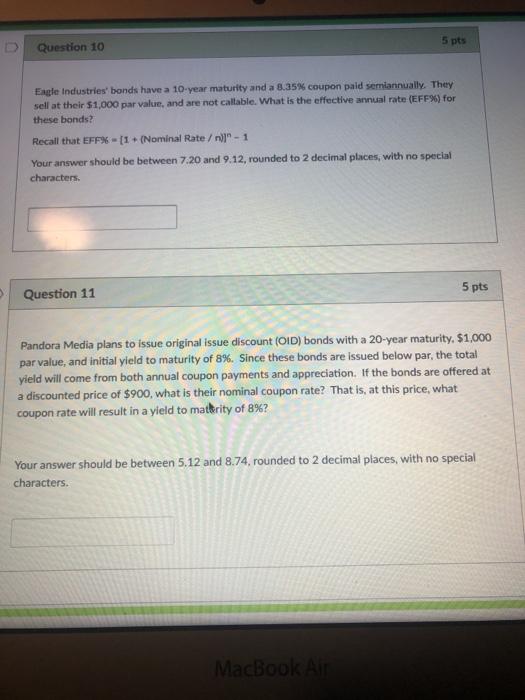

5 pts D Question 10 Eagle Industries' bonds have a 10-year maturity and a 8.35% coupon paid semiannually. They sell at their $1,000 par value and are not callable. What is the effective annual rate (EFF%) for these bonds? Recall that EFF%-[1 + (Nominal Rate / m)" - 1 Your answer should be between 7.20 and 9.12, rounded to 2 decimal places, with no special characters. Question 11 5 pts Pandora Media plans to issue original issue discount (OID) bonds with a 20-year maturity. $1,000 par value, and initial yield to maturity of 8%. Since these bonds are issued below par, the total yield will come from both annual coupon payments and appreciation. If the bonds are offered at a discounted price of $900, what is their nominal coupon rate? That is, at this price, what coupon rate will result in a yield to matbrity of 8%? Your answer should be between 5.12 and 8.74, rounded to 2 decimal places, with no special characters. MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts