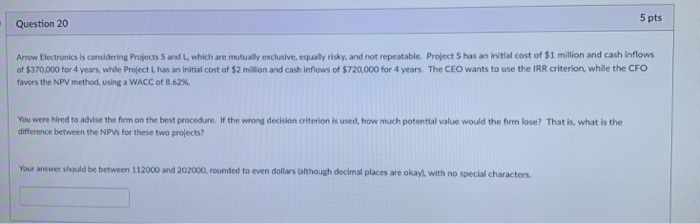

Question: 5 pts Question 20 Arrow Electronics is considering Projects S and L, which are mutualily exclusive, equaly risky, and not repeatable. Project S has an

5 pts Question 20 Arrow Electronics is considering Projects S and L, which are mutualily exclusive, equaly risky, and not repeatable. Project S has an initial cost of $1 million and cash inflows of $370,000 for 4 years, while Project L has an initial cost of $2 million and cash inflows of $720,000 for 4 years. The CEO wants to use the IRR criterion, while the CFO favors the NPV method, using a WACC of 8.62%. You were hired to advise the firm on the best procedure. If the wrong decision criterion is used, how much potential value would the frm lose? That is, what is the difference between the NPWs for these two projects? Your answer should be between 112000 and 202000, rounded to even dollars (although decimal places are okayl, with no special characters

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts