Question: 5. Quark Industries has four potential projects, all with an initial cost of $2,000,000. The capital budget for the year will allow Quark Industries to

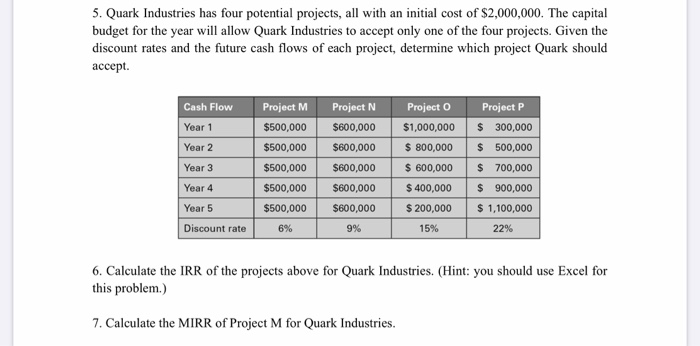

5. Quark Industries has four potential projects, all with an initial cost of $2,000,000. The capital budget for the year will allow Quark Industries to accept only one of the four projects. Given the discount rates and the future cash flows of each project, determine which project Quark should accept Cash Flow Year 1 Year 2 Year 3 Project M $500,000 $500,000 $500,000 $500,000 $500,000 6% Project N $600,000 $600,000 $600,000 $600,000 $600,000 9% Project $1,000,000 $ 800,000 $ 600,000 $ 400,000 $ 200,000 15% Project P $ 300,000 $ 500,000 $ 700,000 $ 900,000 $ 1,100,000 22% Year 4 Year 5 Discount rate 6. Calculate the IRR of the projects above for Quark Industries. (Hint: you should use Excel for this problem.) 7. Calculate the MIRR of Project M for Quark Industries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts