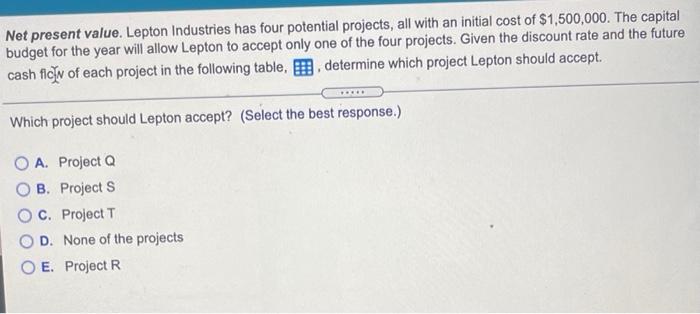

Question: Net present value. Lepton Industries has four potential projects, all with an initial cost of $1,500,000. The capital budget for the year will allow Lepton

Net present value. Lepton Industries has four potential projects, all with an initial cost of $1,500,000. The capital budget for the year will allow Lepton to accept only one of the four projects. Given the discount rate and the future cash fic v of each project in the following table, determine which project Lepton should accept Which project should Lepton accept? (Select the best response.) O A. Project Q OB. Projects c. Project T D. None of the projects OE Project R Net present value. Lepton Industries has four potential projects, all with an initial cost of $1,500,000. The capital budget for the year will allow Lepton to accept only one of the four projects. Given the discount rate and the future cash fic v of each project in the following table, determine which project Lepton should accept Which project should Lepton accept? (Select the best response.) O A. Project Q OB. Projects c. Project T D. None of the projects OE Project R

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts