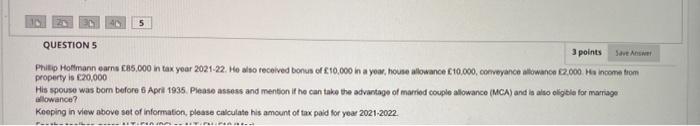

Question: 5 QUESTION 5 3 points Save Answer Philip Hoffmann carns 85.000 in tax your 2021-22. He also received bonus of 10.000 in a you, house

5 QUESTION 5 3 points Save Answer Philip Hoffmann carns 85.000 in tax your 2021-22. He also received bonus of 10.000 in a you, house lowance 10.000,conveyance allowance 2.000 Ha Incometom property is 620,000 His spouso was bom before 6 April 1935. Please assess and mention if he can take the advantage of married couple allowance (MCA) and is also eligible for marriage allowance? Keeping in view above set of information, please calculate his amount of tax paid for year 2021-2022 5 QUESTION 5 3 points Save Answer Philip Hoffmann carns 85.000 in tax your 2021-22. He also received bonus of 10.000 in a you, house lowance 10.000,conveyance allowance 2.000 Ha Incometom property is 620,000 His spouso was bom before 6 April 1935. Please assess and mention if he can take the advantage of married couple allowance (MCA) and is also eligible for marriage allowance? Keeping in view above set of information, please calculate his amount of tax paid for year 2021-2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts