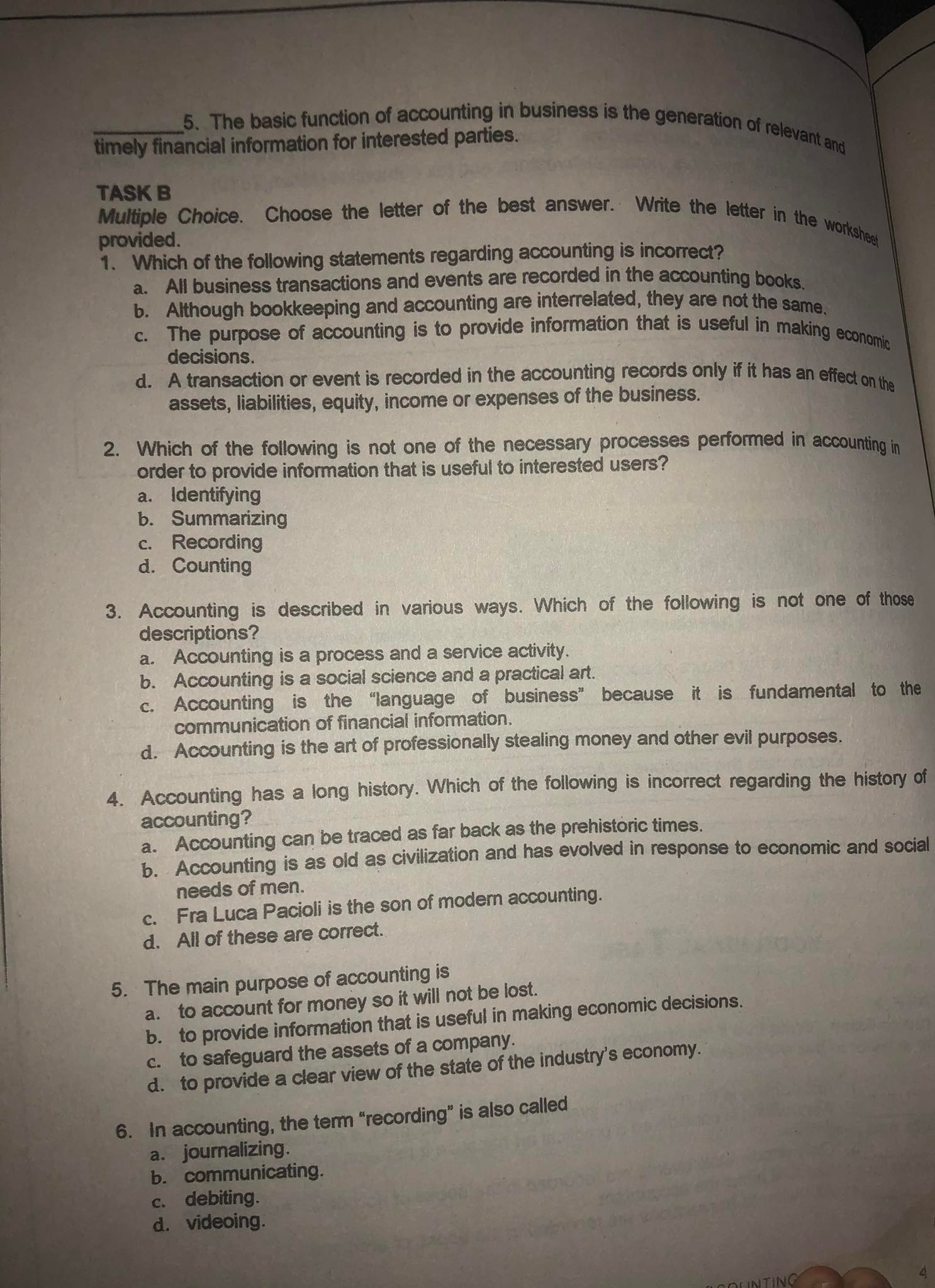

Question: 5. The basic function of accounting in business is the generation of relevant and timely financial information for interested parties. TASK B provided. Multiple Choice.

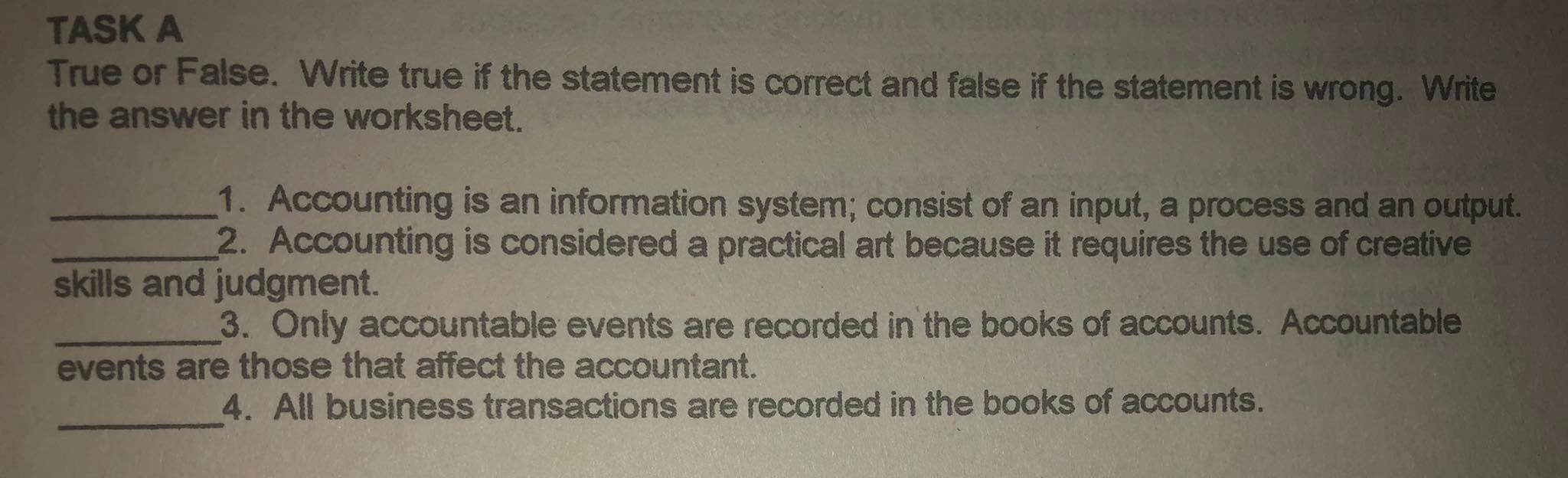

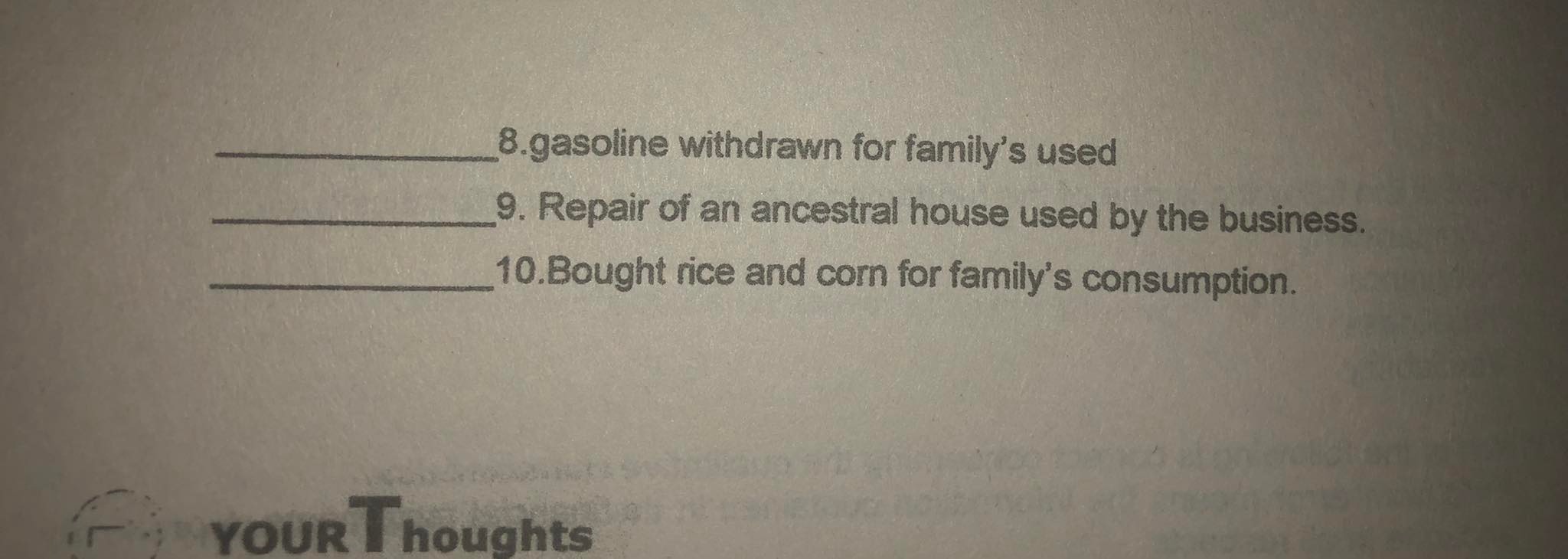

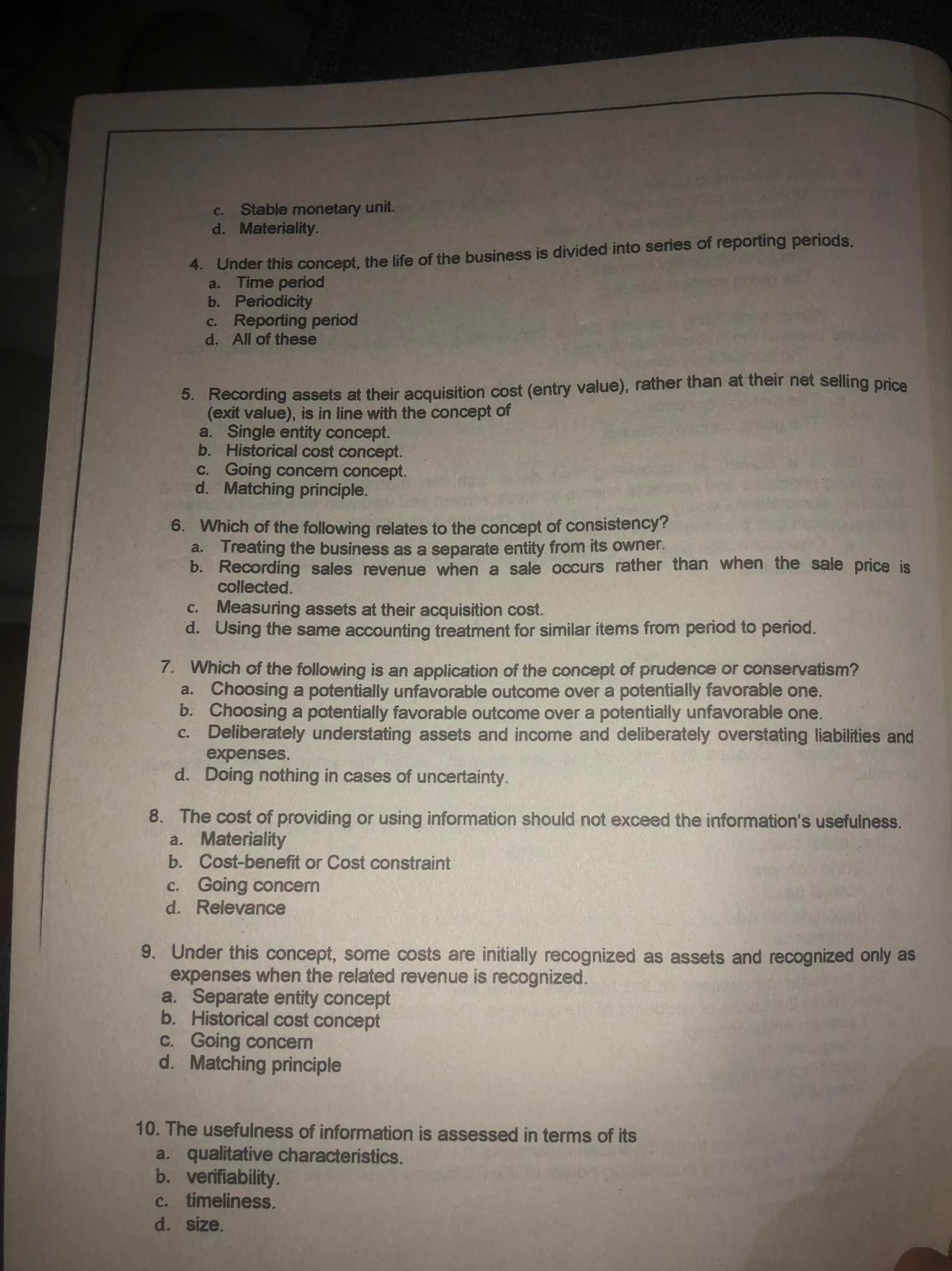

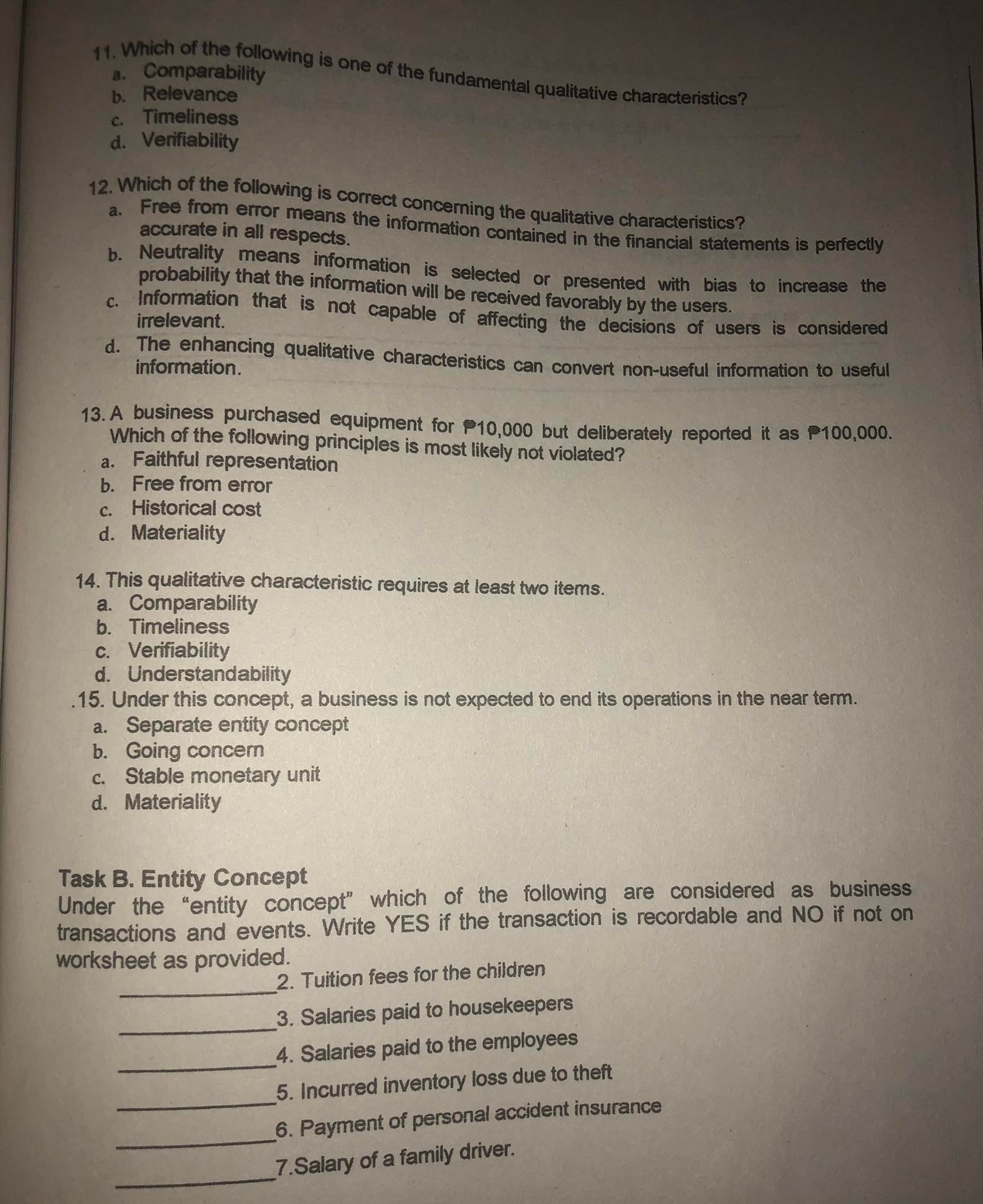

5. The basic function of accounting in business is the generation of relevant and timely financial information for interested parties. TASK B provided. Multiple Choice. Choose the letter of the best answer. Write the letter in the workshort 1. Which of the following statements regarding accounting is incorrect? a. All business transactions and events are recorded in the accounting books. Although bookkeeping and accounting are interrelated, they are not the same. c. The purpose of accounting is to provide information that is useful in making economic decisions. d. A transaction or event is recorded in the accounting records only if it has an effect on the assets, liabilities, equity, income or expenses of the business. 2. Which of the following is not one of the necessary processes performed in accounting in order to provide information that is useful to interested users? a. Identifying b. Summarizing c. Recording d. Counting 3. Accounting is described in various ways. Which of the following is not one of those descriptions? a. Accounting is a process and a service activity. b. Accounting is a social science and a practical art. c. Accounting is the "language of business" because it is fundamental to the communication of financial information. d. Accounting is the art of professionally stealing money and other evil purposes. 4. Accounting has a long history. Which of the following is incorrect regarding the history of accounting? a. Accounting can be traced as far back as the prehistoric times. b. Accounting is as old as civilization and has evolved in response to economic and social needs of men. C. Fra Luca Pacioli is the son of modern accounting. d. All of these are correct. 5. The main purpose of accounting is a. to account for money so it will not be lost. b. to provide information that is useful in making economic decisions. c. to safeguard the assets of a company. d. to provide a clear view of the state of the industry's economy. 6. In accounting, the term "recording" is also called a. journalizing. b. communicating. C. debiting. d. videoing.TASK A True or False. Write true if the statement is correct and false if the statement is wrong. Write the answer in the worksheet. 1. Accounting is an information system; consist of an input, a process and an output. 2. Accounting is considered a practical art because it requires the use of creative skills and judgment. 3. Only accountable events are recorded in the books of accounts. Accountable events are those that affect the accountant. 4. All business transactions are recorded in the books of accounts.8.gasoline withdrawn for family's used 9. Repair of an ancestral house used by the business. 10.Bought rice and corn for family's consumption. YOUR Thoughtsc. Stable monetary unit. d. Materiality. 4. Under this concept, the life of the business is divided into series of reporting periods. a. Time period b. Periodicity c. Reporting period d. All of these Recording assets at their acquisition cost (entry value), rather than at their net selling price (exit value), is in line with the concept of a. Single entity concept. b. Historical cost concept. C . Going concern concept. d. Matching principle. 6. Which of the following relates to the concept of consistency? a. Treating the business as a separate entity from its owner. b. Recording sales revenue when a sale occurs rather than when the sale price is collected. C . Measuring assets at their acquisition cost. d. Using the same accounting treatment for similar items from period to period. 7. Which of the following is an application of the concept of prudence or conservatism? a. Choosing a potentially unfavorable outcome over a potentially favorable one. b. Choosing a potentially favorable outcome over a potentially unfavorable one. c. Deliberately understating assets and income and deliberately overstating liabilities and expenses. d. Doing nothing in cases of uncertainty. 8. The cost of providing or using information should not exceed the information's usefulness. a. Materiality b. Cost-benefit or Cost constraint C . Going concern d. Relevance 9. Under this concept, some costs are initially recognized as assets and recognized only as expenses when the related revenue is recognized. a. Separate entity concept b. Historical cost concept C. Going concern d. Matching principle 10. The usefulness of information is assessed in terms of its a. qualitative characteristics. b. verifiability. c. timeliness. d. size.1. Which of the following is one of the fundamental qualitative characteristics? a. Comparability . Relevance C . Timeliness d. Verifiability a. 12. Which of the following is correct concerning the qualitative characteristics? Free from error means the information contained in the financial statements is perfectly accurate in all respects. b. Neutrality means information is selected or presented with bias to increase the probability that the information will be received favorably by the users. C. irrelevant. Information that is not capable of affecting the decisions of users is considered information. d. The enhancing qualitative characteristics can convert non-useful information to useful 13. A business purchased equipment for P10,000 but deliberately reported it as P100,000. Which of the following principles is most likely not violated? a. Faithful representation b. Free from error C . Historical cost d. Materiality 14. This qualitative characteristic requires at least two items. a. Comparability b. Timeliness c. Verifiability d. Understandability .15. Under this concept, a business is not expected to end its operations in the near term. a. Separate entity concept b. Going concern Stable monetary unit d. Materiality Task B. Entity Concept Under the "entity concept" which of the following are considered as business transactions and events. Write YES if the transaction is recordable and NO if not on worksheet as provided. 2. Tuition fees for the children 3. Salaries paid to housekeepers 4. Salaries paid to the employees 5. Incurred inventory loss due to theft 6. Payment of personal accident insurance 7.Salary of a family driver

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts