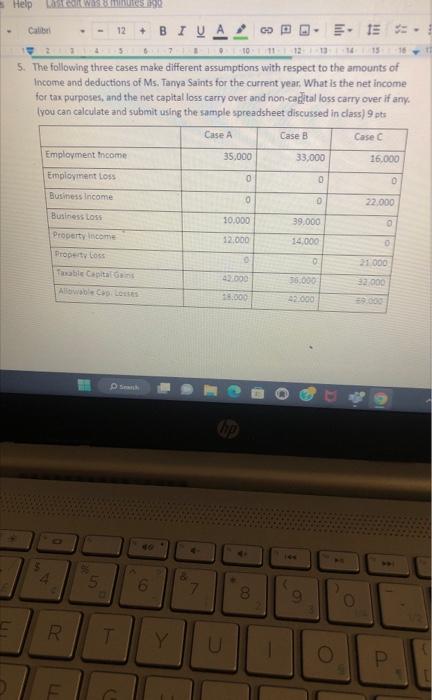

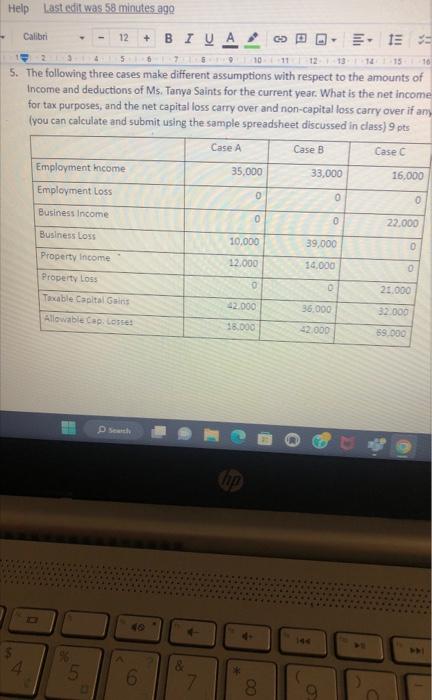

Question: 5. The following three cases make different assumptions with respect to the amounts of Income and deductions of Ms. Tanya Saints for the current year.

5. The following three cases make different assumptions with respect to the amounts of Income and deductions of Ms. Tanya Saints for the current year. What is the net income for tax purposes, and the net capital loss carry over and non-ca hital loss carry over if any. (you can calculate and submit using the sample spreadsheet discussed in class) 9 pts 5. The following three cases make different assumptions with respect to the amounts of income and deductions of Ms. Tanya Saints for the current year. What is the net income for tax purposes, and the net capital loss carry over and non-capital loss carry over if am (you can calculate and submit using the sample spreadsheet discussed in class) 9 pts 5. The following three cases make different assumptions with respect to the amounts of Income and deductions of Ms. Tanya Saints for the current year. What is the net income for tax purposes, and the net capital loss carry over and non-ca hital loss carry over if any. (you can calculate and submit using the sample spreadsheet discussed in class) 9 pts 5. The following three cases make different assumptions with respect to the amounts of income and deductions of Ms. Tanya Saints for the current year. What is the net income for tax purposes, and the net capital loss carry over and non-capital loss carry over if am (you can calculate and submit using the sample spreadsheet discussed in class) 9 pts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts