Question: 5. The probabilistic approach to calculate expected returns Aa Aa Investors are willing to make investments because they expect a return from doing so. As

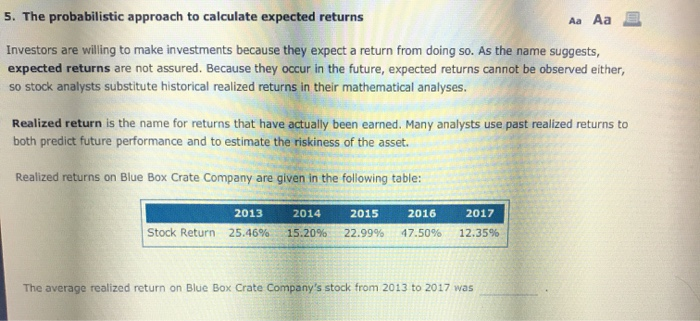

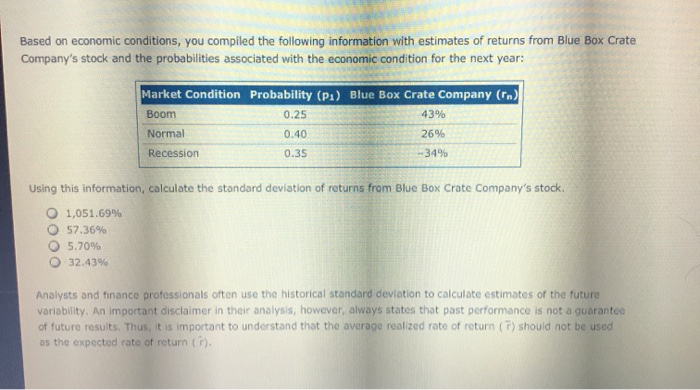

5. The probabilistic approach to calculate expected returns Aa Aa Investors are willing to make investments because they expect a return from doing so. As the name suggests, expected returns are not assured. Because they occur in the future, expected returns cannot be observed either, so stock analysts substitute historical realized returns in their mathematical analyses. Realized return is the name for returns that have actually been earned. Many analysts use past realized returns to both predict future performance and to estimate the riskiness of the asset. Realized returns on Blue Box Crate Company are given in the following table: 2013 2017 2014 2015 2016 15.20% Stock Return 25.46% 47.50% 12.35% 22.99% The average realized return on Blue Box Crate Company's stock from 2013 to 2017 was Based on economic conditions, you compiled the following information with estimates of returns from Blue Box Crate Company's stock and the probabilities associated with the economic condition for the next year: Market Condition Probability (P1) Blue Box Crate Company (rn) 43 % Boom 0.25 Normal 26% 0.40 Recession 0.35 -34% Using this information, calculate the standard deviation of returns from Blue Box Crate Company's stock. 1,051.69% 57.36 % 5.70% 32.43% Analysts and finance professionals often use the historical standard deviation to calculate estimates of the future variability. An important disclaimer in their analysis, however, always states that past performance is not a guarantee of future results. Thus, it is important to understand that the average realized rate of return (7) should not be used as the expected rate of return (r)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts