Question: 5. This question concerns the hedging strategy that MG used to hedge its long-term fixed-rate supply contracts for heating oil (i.e., MG promised to sell

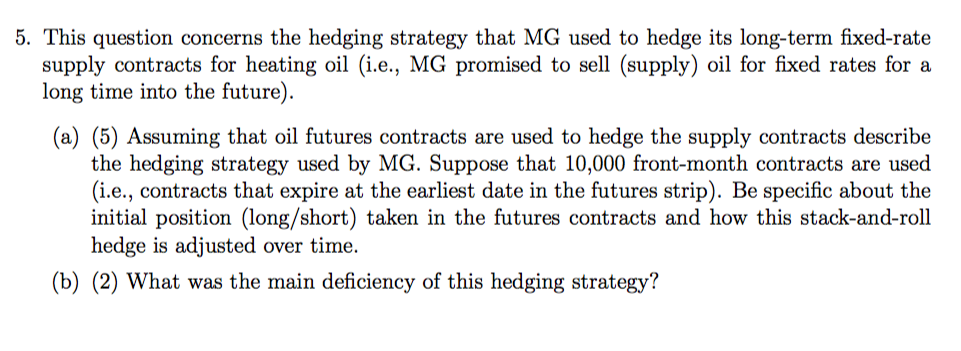

5. This question concerns the hedging strategy that MG used to hedge its long-term fixed-rate supply contracts for heating oil (i.e., MG promised to sell (supply) oil for fixed rates for a long time into the future). (a) (5) Assuming that oil futures contracts are used to hedge the supply contracts describe the hedging strategy used by MG. Suppose that 10,000 front-month contracts are used (i.e., contracts that expire at the earliest date in the futures strip). Be specific about the initial position (long/short) taken in the futures contracts and how this stack-and-roll hedge is adjusted over time. (b) (2) What was the main deficiency of this hedging strategy? 5. This question concerns the hedging strategy that MG used to hedge its long-term fixed-rate supply contracts for heating oil (i.e., MG promised to sell (supply) oil for fixed rates for a long time into the future). (a) (5) Assuming that oil futures contracts are used to hedge the supply contracts describe the hedging strategy used by MG. Suppose that 10,000 front-month contracts are used (i.e., contracts that expire at the earliest date in the futures strip). Be specific about the initial position (long/short) taken in the futures contracts and how this stack-and-roll hedge is adjusted over time. (b) (2) What was the main deficiency of this hedging strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts