Question: 5. Tim the Tool Man has estimated what his materials will cost over the next 5 years. He estimates his company wants to achieve a

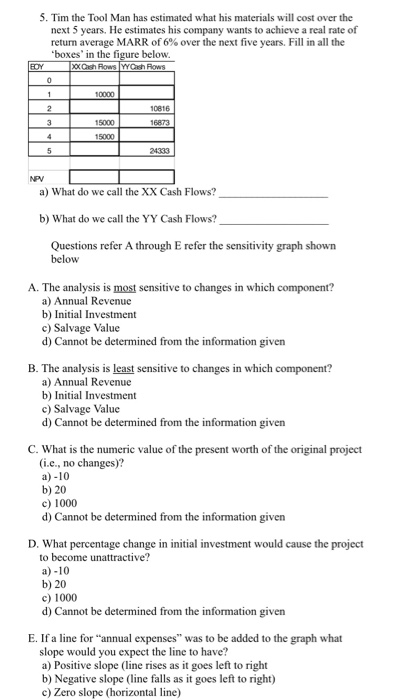

5. Tim the Tool Man has estimated what his materials will cost over the next 5 years. He estimates his company wants to achieve a real rate of return average MARR of 6% over the next five years. Fill in all the boxes in the figure belovw 0816 15000 15000 24333 NPV a) What do we call the XX Cash Flows? b) What do we call the YY Cash Flows? Questions refer A through E refer the sensitivity graph shown below A. The analysis is most sensitive to changes in which component? a) Annual Revenuc b) Initial Investment c) Salvage Value d) Cannot be determined from the information given B. The analysis is least sensitive to changes in which component? a) Annual Revenue b) Initia Investment c) Salvage Value d) Cannot be determined from the information given C. What is the numeric value of the present worth of the original project (i.e., no changes)? a)-10 b) 20 c) 1000 d) Cannot be determined from the information given D. What percentage change in initial investment would cause the project to become unattractive? a) -10 b) 20 c) 1000 d) Cannot be determined from the information given E. If a line for "annual expenses" was to be added to the graph what slope would you expect the line to have? a) Positive slope (line rises as it goes left to right b) Negative slope (line falls as it goes left to right) c) Zero slope (horizontal line)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts