Question: 5 to 8 please Student Name (Please Print) _ 5) Dyl Inc.'s bonds currently sell for $870 and have a par value of $1,000. They

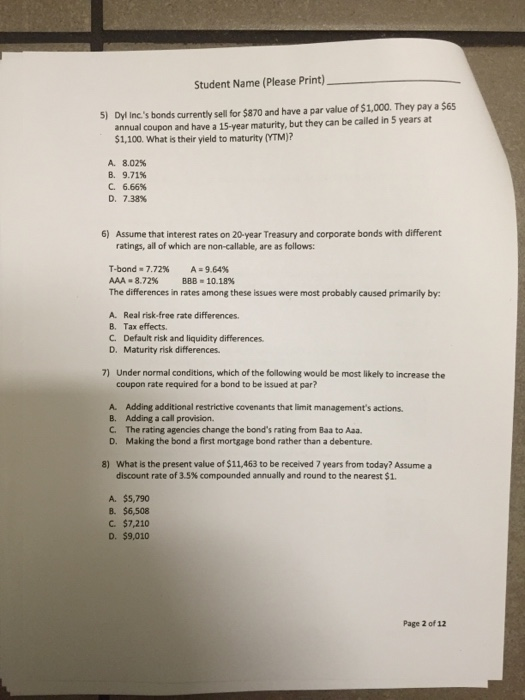

Student Name (Please Print) _ 5) Dyl Inc.'s bonds currently sell for $870 and have a par value of $1,000. They pay a $65 annual coupon and have a 15-year maturity, but they can be called in 5 years at $1,100. What is their yield to maturity (YTM)? A. 8.02% B. 9.71% C. 6.66% D. 738% 6) Assume that interest rates on 20-year Treasury and corporate bonds with different ratings, all of which are non-callable, are as follows: T-bond -7.72% A = 9.64% AAA-8.72% BBB - 10.18% The differences in rates among these issues were most probably caused primarily by: A. Real risk-free rate differences. B. Tax effects. C. Default risk and liquidity differences. D. Maturity risk differences. 7) Under normal conditions, which of the following would be most likely to increase the coupon rate required for a bond to be issued at par? A. Adding additional restrictive covenants that limit management's actions. B. Adding a call provision C. The rating agencies change the bond's rating from Baa to Aaa. D. Making the bond a first mortgage bond rather than a debenture. 8) What is the present value of $11,463 to be received 7 years from today? Assume a discount rate of 3.5% compounded annually and round to the nearest $1. A. $5,790 B. $6,508 C. $7,210 D. $9,010 Page 2 of 12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts