Question: 5. Using the monthly return data on the four stocks of your choice (excluding Boeing, Microsoft, Nordstrom and Starbucks) over the period January, 2015 to

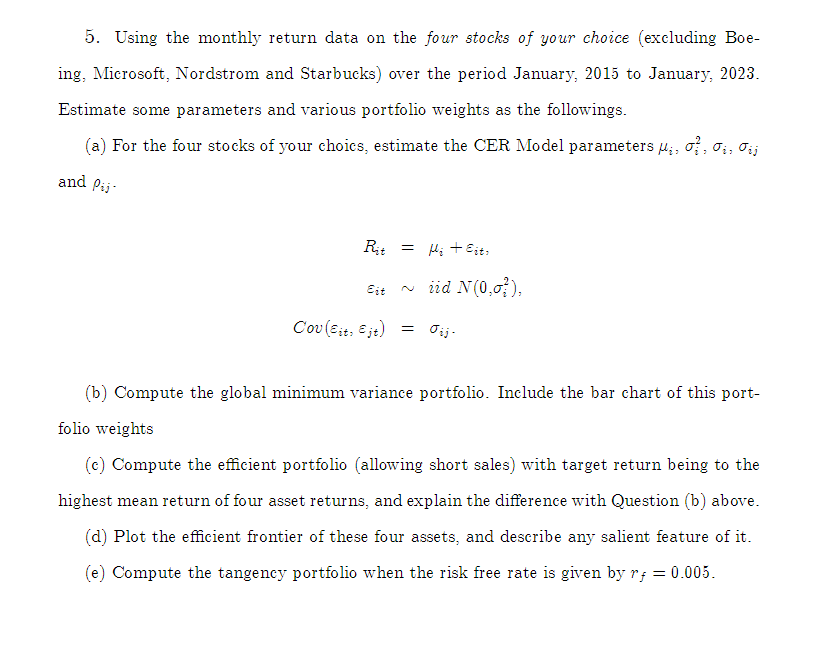

5. Using the monthly return data on the four stocks of your choice (excluding Boeing, Microsoft, Nordstrom and Starbucks) over the period January, 2015 to January, 2023. Estimate some parameters and various portfolio weights as the followings. (a) For the four stocks of your choics, estimate the CER Model parameters i,i2,i,ij and ij RititCov(it,jt)=i+it,iidN(0,i2),=ij. (b) Compute the global minimum variance portfolio. Include the bar chart of this portfo lio weights (c) Compute the efficient portfolio (allowing short sales) with target return being to the highest mean return of four asset returns, and explain the difference with Question (b) above. (d) Plot the efficient frontier of these four assets, and describe any salient feature of it. (e) Compute the tangency portfolio when the risk free rate is given by rf=0.005

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts