Question: 5. Will rate the answer. The two following separate cases show the financial position of a parent company and its subsidiary company on November 30,

5.

Will rate the answer.

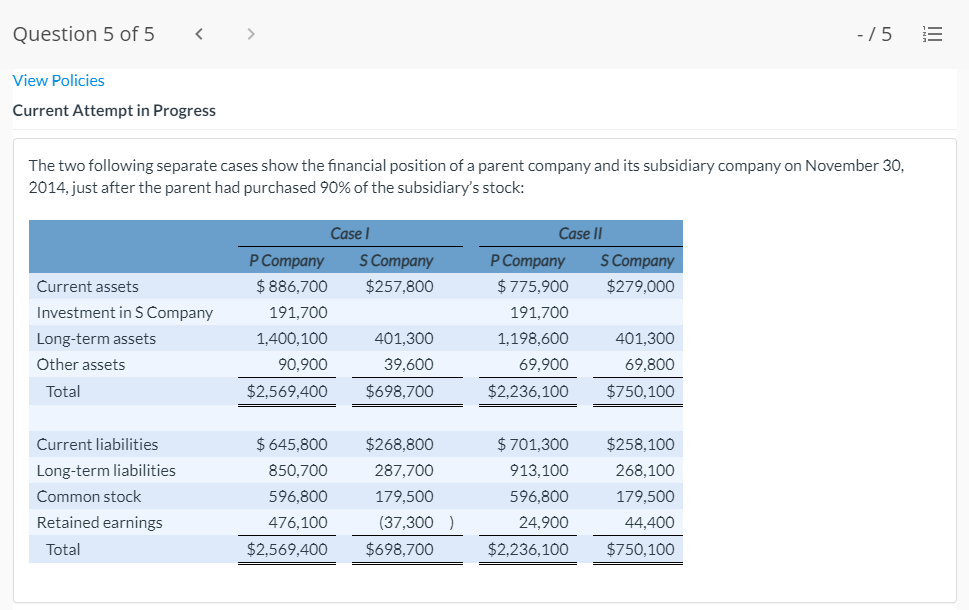

The two following separate cases show the financial position of a parent company and its subsidiary company on November 30, 2014, just after the parent had purchased 90% of the subsidiarys stock:

| Case I | Case II | ||||||||

| P Company | S Company | P Company | S Company | ||||||

| Current assets | $ 886,700 | $257,800 | $ 775,900 | $279,000 | |||||

| Investment in S Company | 191,700 | 191,700 | |||||||

| Long-term assets | 1,400,100 | 401,300 | 1,198,600 | 401,300 | |||||

| Other assets | 90,900 | 39,600 | 69,900 | 69,800 | |||||

| Total | $2,569,400 | $698,700 | $2,236,100 | $750,100 | |||||

| Current liabilities | $ 645,800 | $268,800 | $ 701,300 | $258,100 | |||||

| Long-term liabilities | 850,700 | 287,700 | 913,100 | 268,100 | |||||

| Common stock | 596,800 | 179,500 | 596,800 | 179,500 | |||||

| Retained earnings | 476,100 | (37,300 | ) | 24,900 | 44,400 | ||||

| Total | $2,569,400 | $698,700 | $2,236,100 | $750,100 | |||||

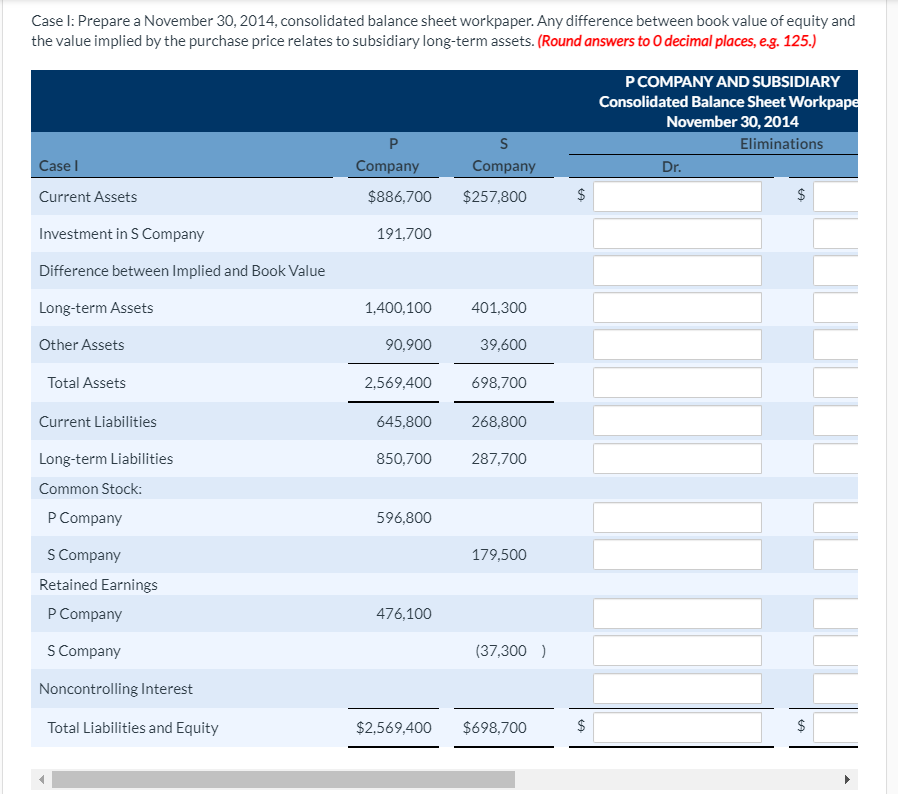

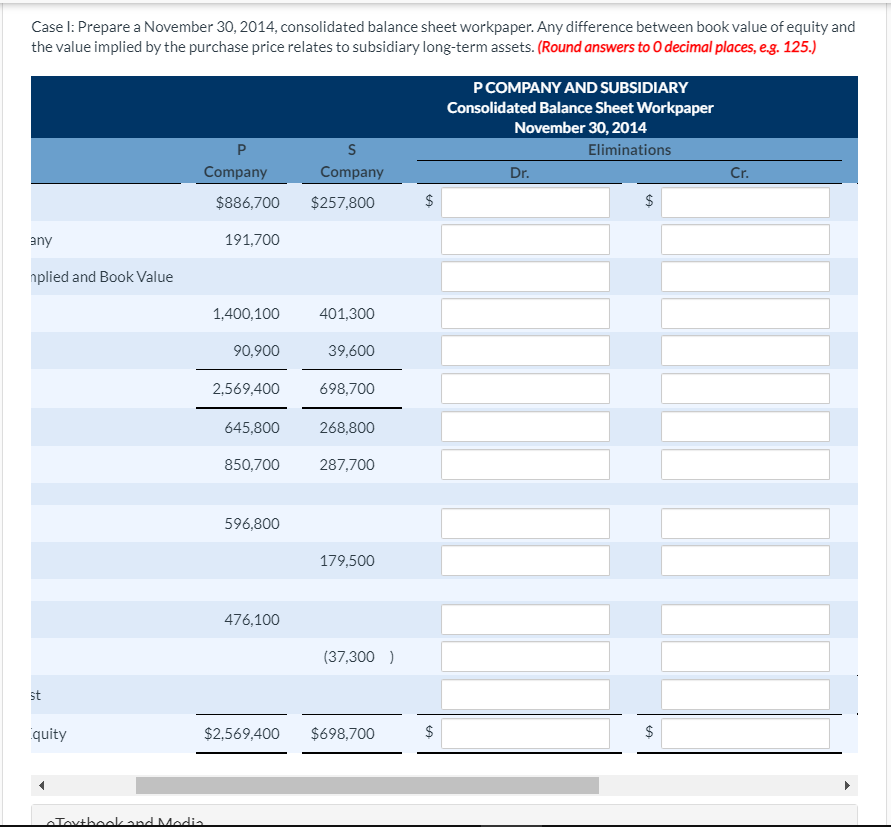

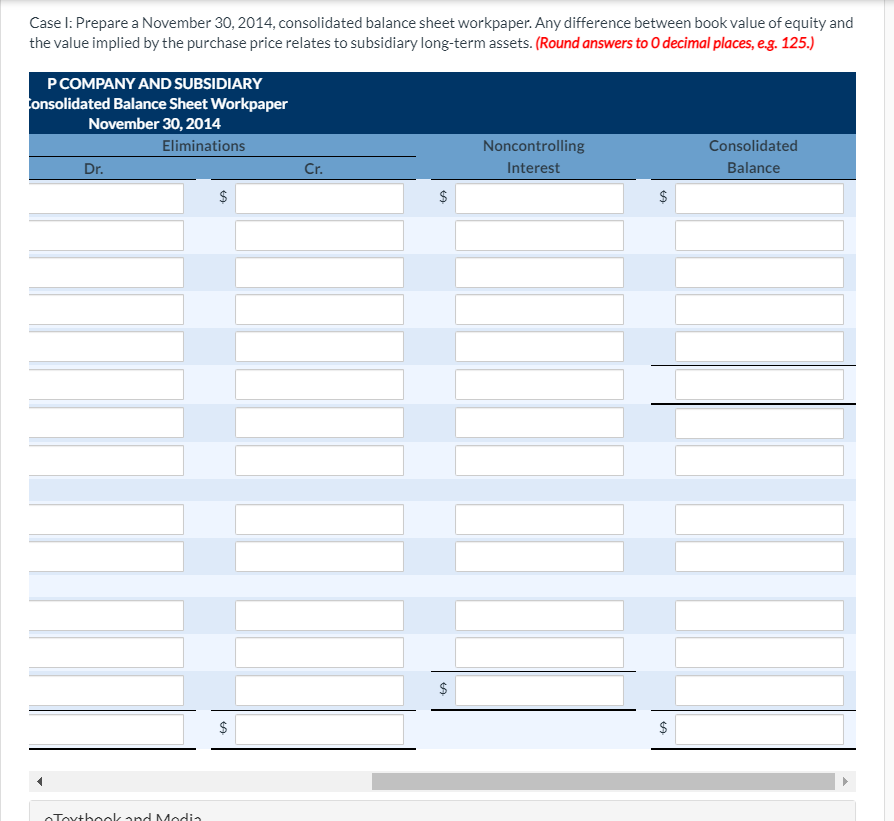

Question 5 of 5 - / 5 !!! View Policies Current Attempt in Progress The two following separate cases show the financial position of a parent company and its subsidiary company on November 30, 2014, just after the parent had purchased 90% of the subsidiary's stock: Current assets Investment in S Company Long-term assets Other assets Total Case P Company S Company $ 886,700 $257,800 191,700 1,400,100 401,300 90,900 39,600 $2,569,400 $698,700 Case II P Company S Company $ 775,900 $279,000 191,700 1,198,600 401,300 69,900 69,800 $2,236,100 $750,100 Current liabilities Long-term liabilities Common stock Retained earnings Total $ 645,800 850,700 596,800 476,100 $2,569,400 $268,800 287,700 179,500 (37,300) $698,700 $ 701,300 913,100 596,800 24,900 $2,236,100 $258,100 268,100 179,500 44,400 $750,100 Case I: Prepare a November 30, 2014, consolidated balance sheet workpaper. Any difference between book value of equity and the value implied by the purchase price relates to subsidiary long-term assets. (Round answers to decimal places, e.g. 125.) P COMPANY AND SUBSIDIARY Consolidated Balance Sheet Workpape November 30, 2014 Eliminations Dr. Company S Company Case Current Assets $886,700 $257,800 $ $ $ 191,700 Investment in Company Difference between Implied and Book Value Long-term Assets 1,400,100 401,300 Other Assets 90,900 39,600 Total Assets 2,569,400 698,700 645,800 268,800 850,700 287,700 Current Liabilities Long-term Liabilities Common Stock: P Company 596,800 179,500 S Company Retained Earnings P Company S Company 476,100 (37,300) Noncontrolling Interest Total Liabilities and Equity $2,569,400 $698,700 $ HA $ $ Case I: Prepare a November 30, 2014, consolidated balance sheet workpaper. Any difference between book value of equity and the value implied by the purchase price relates to subsidiary long-term assets. (Round answers to decimal places, e.g. 125.) P COMPANY AND SUBSIDIARY Consolidated Balance Sheet Workpaper November 30, 2014 Eliminations Company $886,700 S Company Dr. Cr. $257,800 $ $ any 191,700 nplied and Book Value 1,400,100 401,300 90,900 39,600 2,569,400 698,700 645,800 268,800 850,700 287,700 596,800 179,500 476,100 (37.300) st quity $2,569,400 $698,700 $ $ Tatbaaland Madia Case I: Prepare a November 30, 2014, consolidated balance sheet workpaper. Any difference between book value of equity and the value implied by the purchase price relates to subsidiary long-term assets. (Round answers to decimal places, e.g. 125.) P COMPANY AND SUBSIDIARY fonsolidated Balance Sheet Workpaper November 30, 2014 Eliminations Noncontrolling Interest Consolidated Balance Dr. Cr. $ $ $ $ $ $ $ HA Toutbooland Media Question 5 of 5 - / 5 !!! View Policies Current Attempt in Progress The two following separate cases show the financial position of a parent company and its subsidiary company on November 30, 2014, just after the parent had purchased 90% of the subsidiary's stock: Current assets Investment in S Company Long-term assets Other assets Total Case P Company S Company $ 886,700 $257,800 191,700 1,400,100 401,300 90,900 39,600 $2,569,400 $698,700 Case II P Company S Company $ 775,900 $279,000 191,700 1,198,600 401,300 69,900 69,800 $2,236,100 $750,100 Current liabilities Long-term liabilities Common stock Retained earnings Total $ 645,800 850,700 596,800 476,100 $2,569,400 $268,800 287,700 179,500 (37,300) $698,700 $ 701,300 913,100 596,800 24,900 $2,236,100 $258,100 268,100 179,500 44,400 $750,100 Case I: Prepare a November 30, 2014, consolidated balance sheet workpaper. Any difference between book value of equity and the value implied by the purchase price relates to subsidiary long-term assets. (Round answers to decimal places, e.g. 125.) P COMPANY AND SUBSIDIARY Consolidated Balance Sheet Workpape November 30, 2014 Eliminations Dr. Company S Company Case Current Assets $886,700 $257,800 $ $ $ 191,700 Investment in Company Difference between Implied and Book Value Long-term Assets 1,400,100 401,300 Other Assets 90,900 39,600 Total Assets 2,569,400 698,700 645,800 268,800 850,700 287,700 Current Liabilities Long-term Liabilities Common Stock: P Company 596,800 179,500 S Company Retained Earnings P Company S Company 476,100 (37,300) Noncontrolling Interest Total Liabilities and Equity $2,569,400 $698,700 $ HA $ $ Case I: Prepare a November 30, 2014, consolidated balance sheet workpaper. Any difference between book value of equity and the value implied by the purchase price relates to subsidiary long-term assets. (Round answers to decimal places, e.g. 125.) P COMPANY AND SUBSIDIARY Consolidated Balance Sheet Workpaper November 30, 2014 Eliminations Company $886,700 S Company Dr. Cr. $257,800 $ $ any 191,700 nplied and Book Value 1,400,100 401,300 90,900 39,600 2,569,400 698,700 645,800 268,800 850,700 287,700 596,800 179,500 476,100 (37.300) st quity $2,569,400 $698,700 $ $ Tatbaaland Madia Case I: Prepare a November 30, 2014, consolidated balance sheet workpaper. Any difference between book value of equity and the value implied by the purchase price relates to subsidiary long-term assets. (Round answers to decimal places, e.g. 125.) P COMPANY AND SUBSIDIARY fonsolidated Balance Sheet Workpaper November 30, 2014 Eliminations Noncontrolling Interest Consolidated Balance Dr. Cr. $ $ $ $ $ $ $ HA Toutbooland Media

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts