Question: **NEED HELP WITH PART B ONLY**** The two following separate cases show the financial position of a parent company and its subsidiary company on November

**NEED HELP WITH PART B ONLY****

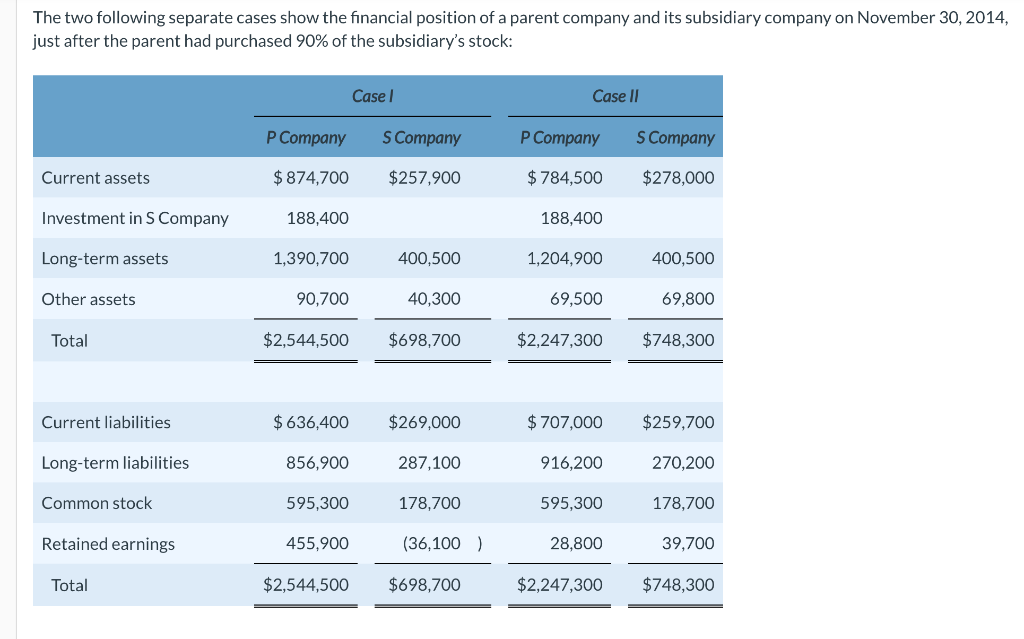

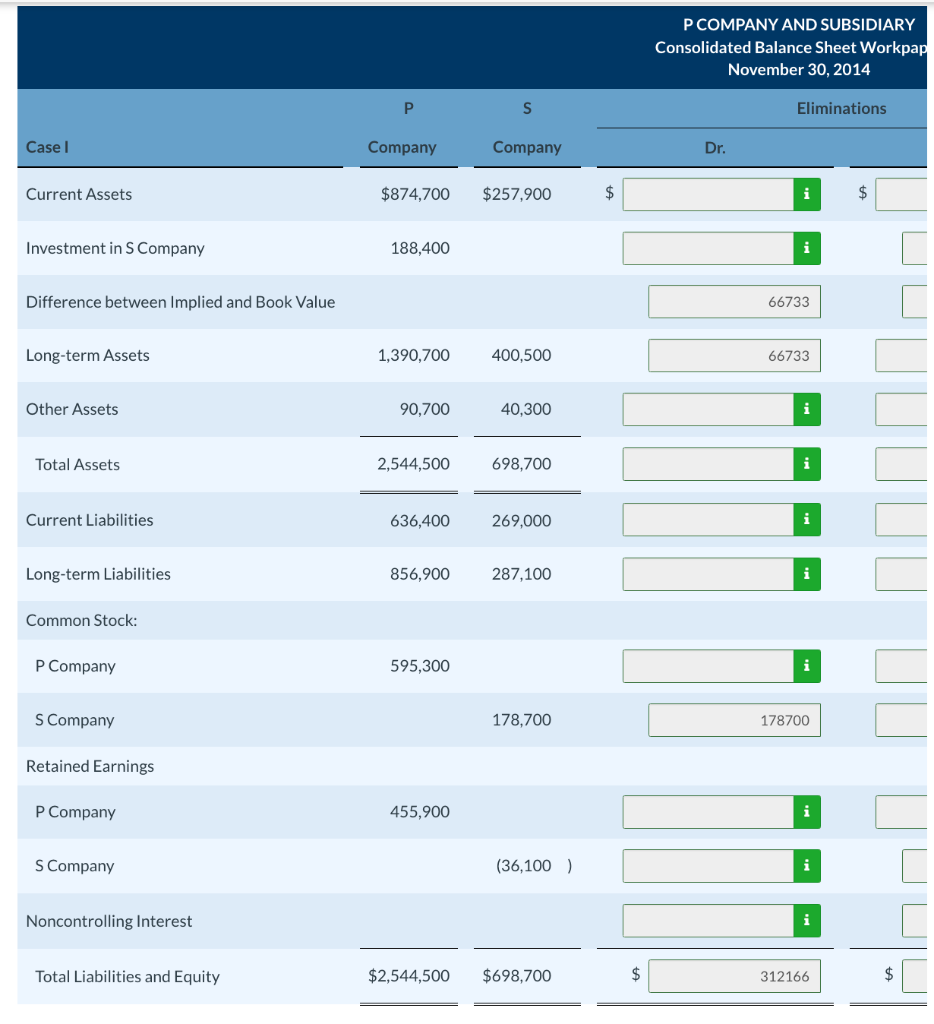

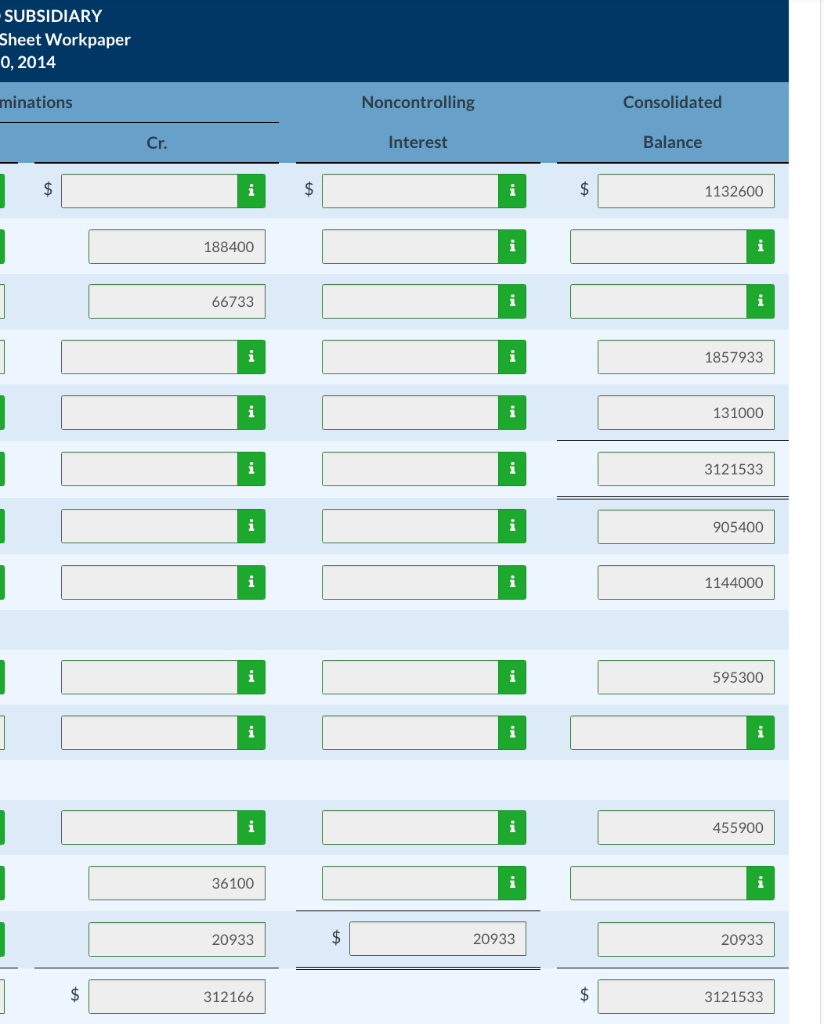

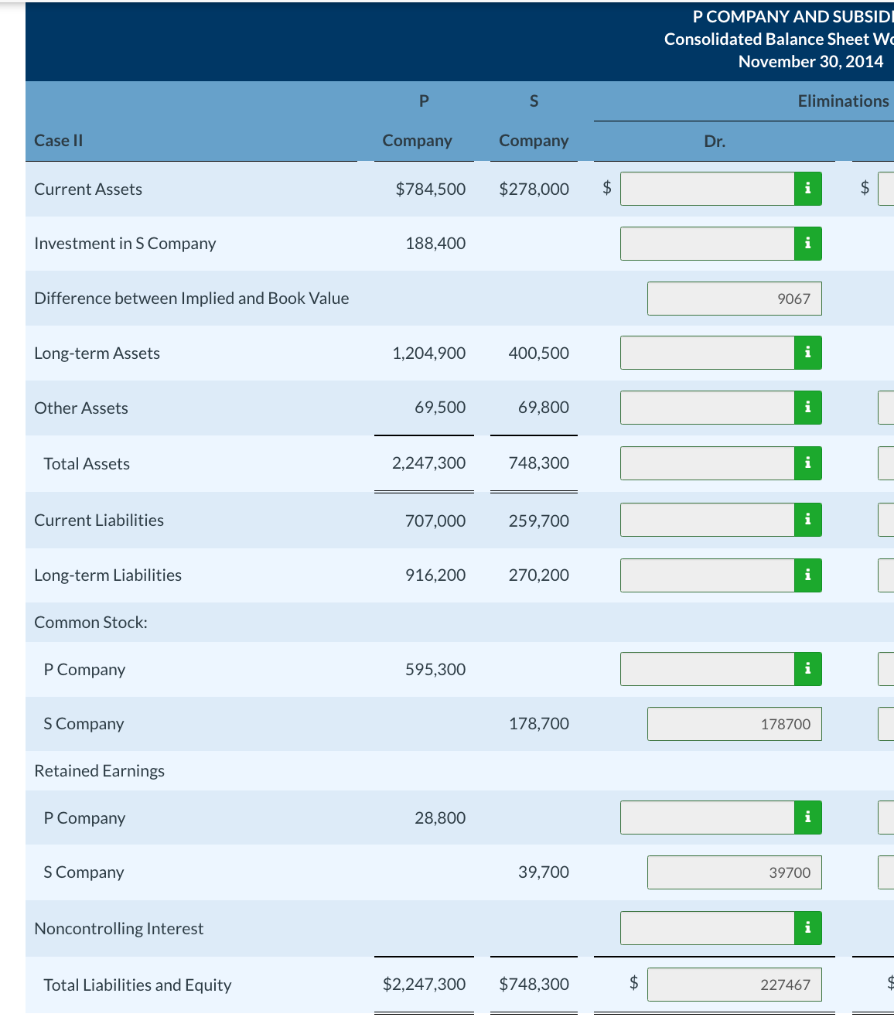

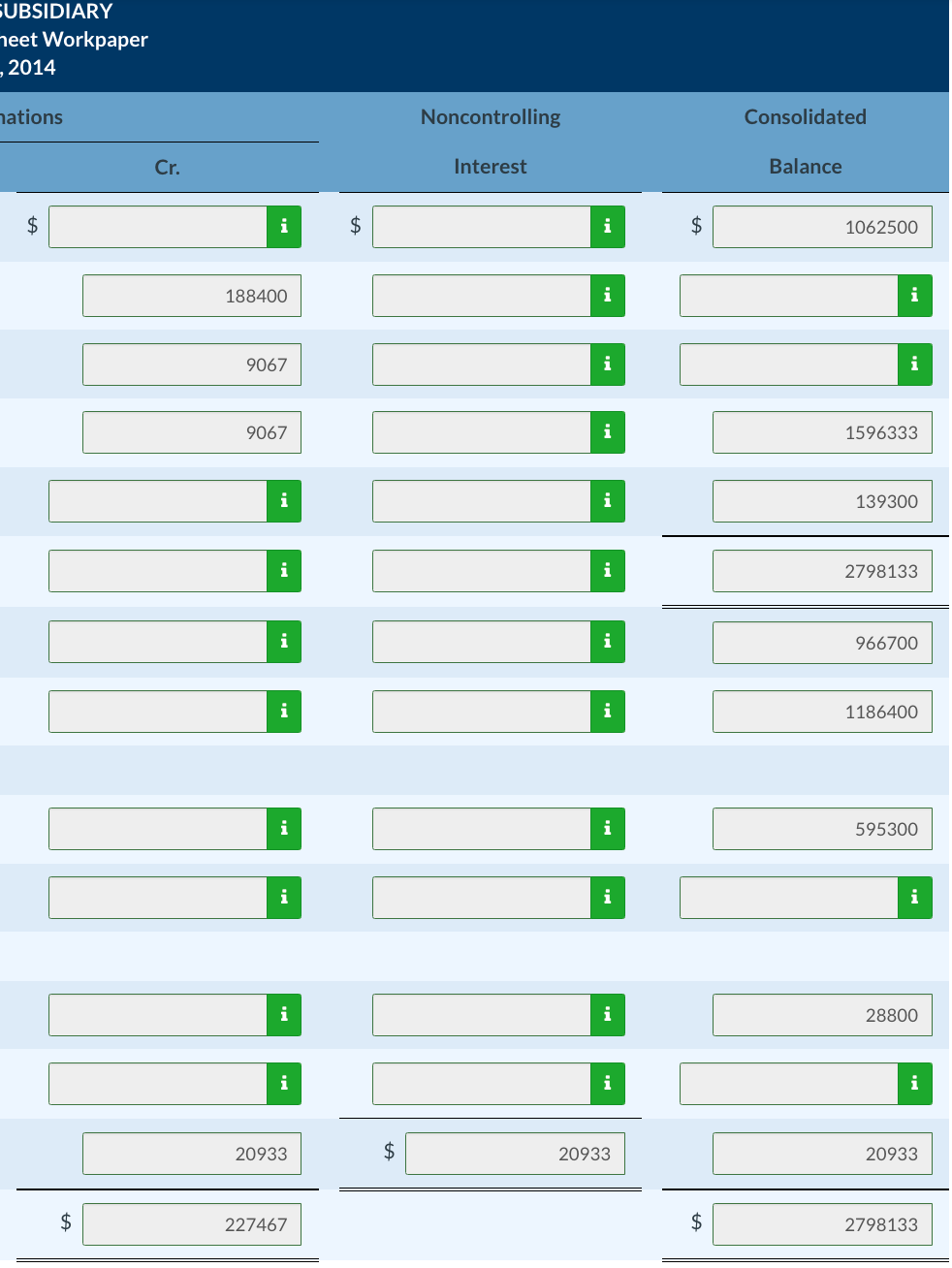

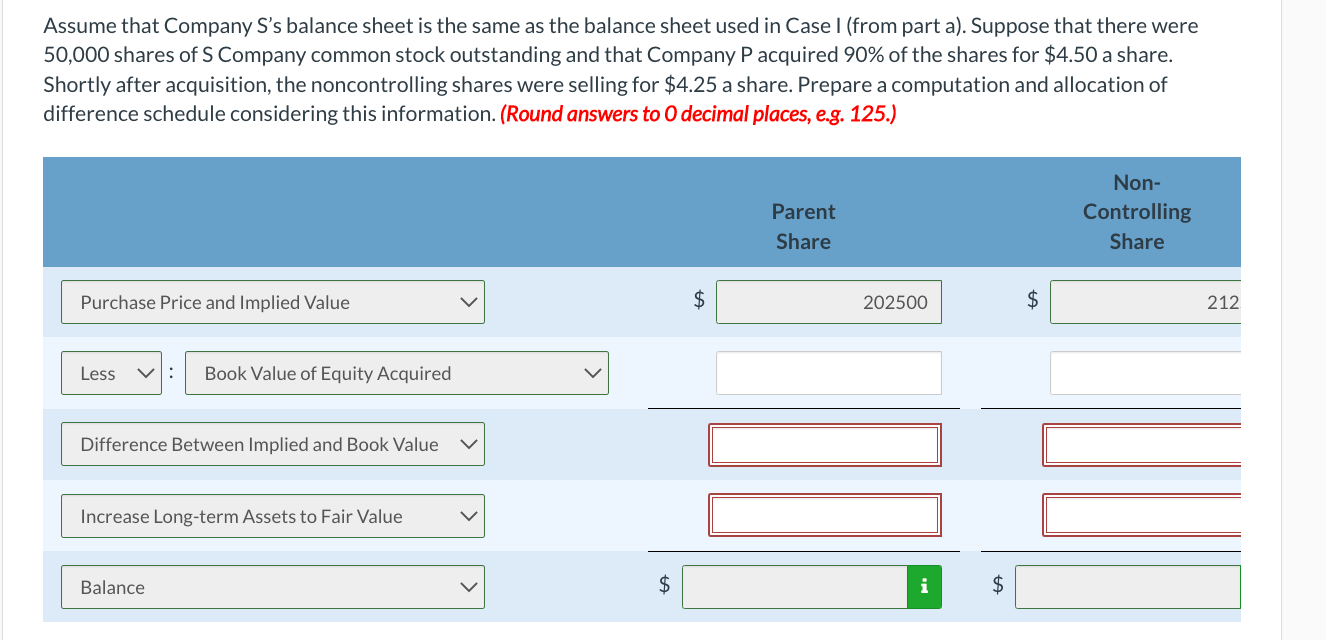

The two following separate cases show the financial position of a parent company and its subsidiary company on November 30, 2014, just after the parent had purchased 90% of the subsidiary's stock: Case Case II P Company S Company P Company 5 Company Current assets $ 874,700 $257,900 $ 784,500 $278,000 Investment in S Company 188,400 188,400 Long-term assets 1,390,700 400,500 1,204,900 400,500 Other assets 90,700 40,300 69,500 69,800 Total $2,544,500 $698,700 $2,247,300 $748,300 Current liabilities $636,400 $269,000 $ 707,000 $259,700 Long-term liabilities 856,900 287,100 6,20 270,200 Common stock 595,300 178,700 595,300 178,700 Retained earnings 455,900 (36,100) 28,800 39,700 Total $2,544,500 $698,700 $2,247,300 $748,300 P COMPANY AND SUBSIDIARY Consolidated Balance Sheet Workpap November 30, 2014 S Eliminations Case Company Company Dr. Current Assets $874,700 $257,900 $ i $ Investment in S Company 188,400 i Difference between Implied and Book Value 66733 Long-term Assets 1,390,700 400,500 66733 Other Assets 90,700 40,300 i Total Assets 2,544,500 698,700 i Current Liabilities 636,400 269,000 i Long-term Liabilities 856,900 287,100 i Common Stock: P Company 595,300 i S Company 178,700 178700 Retained Earnings P Company 455,900 i S Company (36,100) i Noncontrolling Interest Total Liabilities and Equity $2,544,500 $698,700 $ ta 312166 SUBSIDIARY Sheet Workpaper 0, 2014 minations Noncontrolling Consolidated Cr. Interest Balance i $ i $ 1132600 188400 i i ] 66733 i i i i 1857933 i i 131000 i 3121533 i 905400 i i 1144000 i i 595300 i i i i 455900 36100 i i 20933 $ 20933 20933 $ 312166 $ 3121533 P COMPANY AND SUBSIDI Consolidated Balance Sheet Wc November 30, 2014 S Eliminations Case II Company Company Dr. Current Assets $784,500 $278,000 $ i $ Investment in S Company 188,400 i Difference between Implied and Book Value 9067 Long-term Assets 1,204,900 400,500 i Other Assets 69,500 69,800 i Total Assets 2,247,300 748,300 i Current Liabilities 707,000 259,700 i Long-term Liabilities 916,200 270,200 i Common Stock: P Company 595,300 i S Company 178,700 178700 Retained Earnings P Company 28,800 i S Company 39,700 39700 Noncontrolling Interest i Total Liabilities and Equity $2,247,300 $748,300 $ 227467 $ UBSIDIARY heet Workpaper 2014 nations Noncontrolling Consolidated Cr. Interest Balance $ $ $ 1062500 188400 i i 9067 i i 9067 i 1596333 i i 139300 i i 2798133 966700 i i 1186400 i i 595300 i i i i i 28800 i i i 20933 $ 20933 20933 $ 227467 $ 2798133 Assume that Company S's balance sheet is the same as the balance sheet used in Case 1 (from part a). Suppose that there were 50,000 shares of S Company common stock outstanding and that Company Pacquired 90% of the shares for $4.50 a share. Shortly after acquisition, the noncontrolling shares were selling for $4.25 a share. Prepare a computation and allocation of difference schedule considering this information. (Round answers to 0 decimal places, e.g. 125.) Parent Share Non- Controlling Share Purchase Price and Implied Value $ 202500 $ 212 Less Book Value of Equity Acquired Difference Between Implied and Book Value Increase Long-term Assets to Fair Value Balance $ i $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts