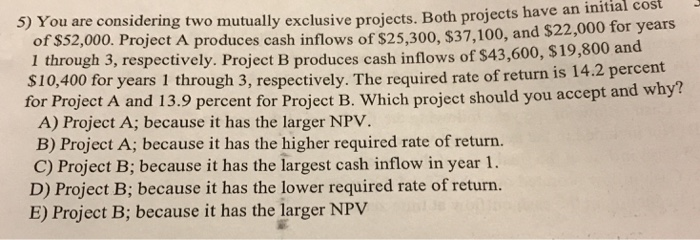

Question: 5) You are co nsidering two mutually exclusive projects. Both projects have an initial cost of $52,000. P 1 thro $10,400 for years 1 through

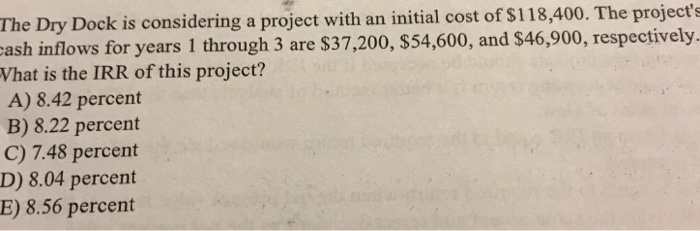

5) You are co nsidering two mutually exclusive projects. Both projects have an initial cost of $52,000. P 1 thro $10,400 for years 1 through 3, respectively. The required rate roject A produces cash inflows of S25,300, $37,100, and $22,000 for years ugh 3, respectively. Project B produces cash inflows of $43,600, $19,800 and of return is 14.2 percent for Project A and 13.9 percent for Project B. Which project should you accept and why? A) Project A; because it has the larger NPV. B) Project A; because it has the higher required rate of return. C) Project B; because it has the largest cash inflow in year 1. D) Project B; because it has the lower required rate of return. E) Project B; because it has the larger NPV The Dry Dock is considering a project with an initial cost of $118,400. The project's ash inflows for years 1 through 3 are $37,200, $54,600, and $46,900, respectively Vhat is the IRR of this project? A) 8.42 percent B) 8.22 percent C) 7.48 percent D) 8.04 percent B) 8.56 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts