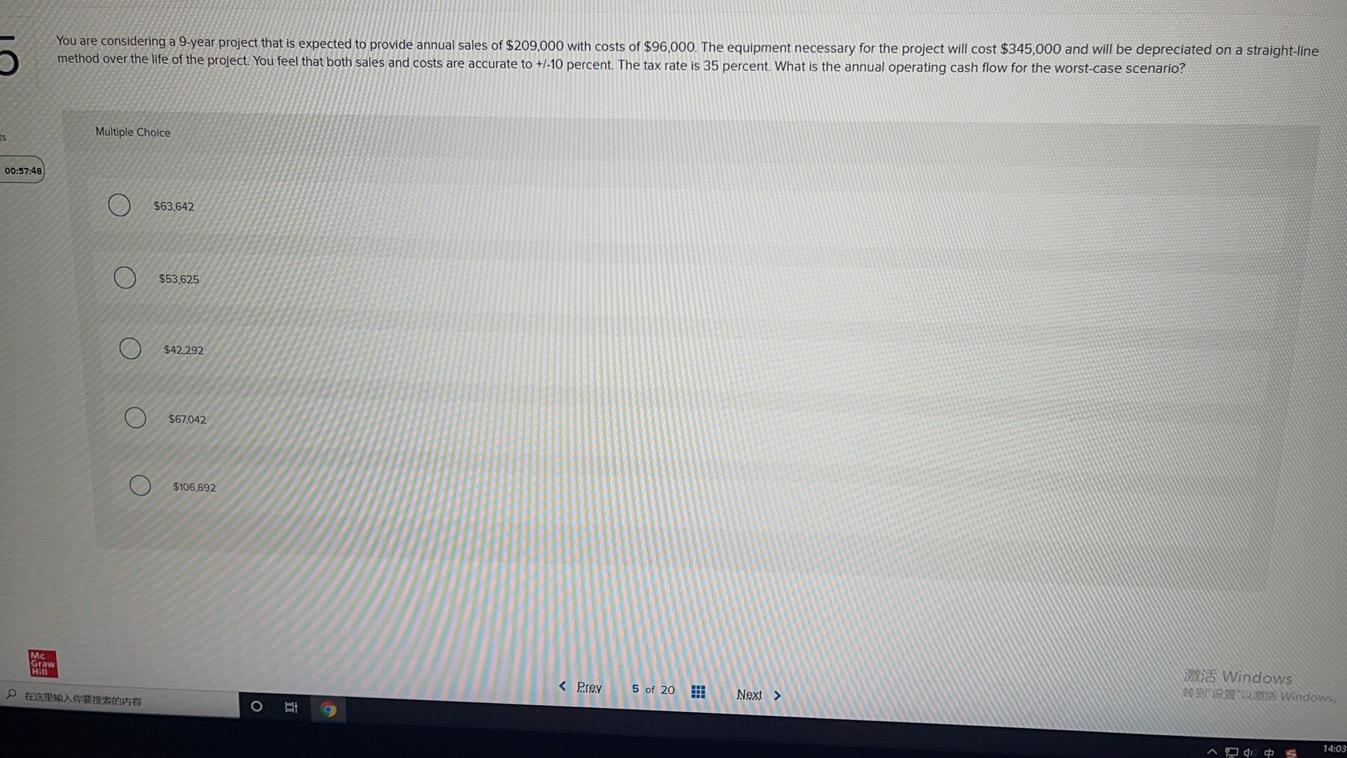

Question: 5 You are considering a 9-year project that is expected to provide annual sales of $209,000 with costs of $96,000. The equipment necessary for the

5 You are considering a 9-year project that is expected to provide annual sales of $209,000 with costs of $96,000. The equipment necessary for the project will cost $345,000 and will be depreciated on a straight-line method over the life of the project. You feel that both sales and costs are accurate to +/-10 percent. The tax rate is 35 percent. What is the annual operating cash flow for the worst-case scenario? Multiple Choice ES 00:57:48 $63,642 $53,625 O $42.292 $67.042 $106,692 MC Graw O Ads 14:03

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts