Question: help (A) 1.67+ b) 4,40+ () 5 . 10s= a) 5.73% (i) 130 is Percent, and 4 , kl peroent, respectively. What is ehe book

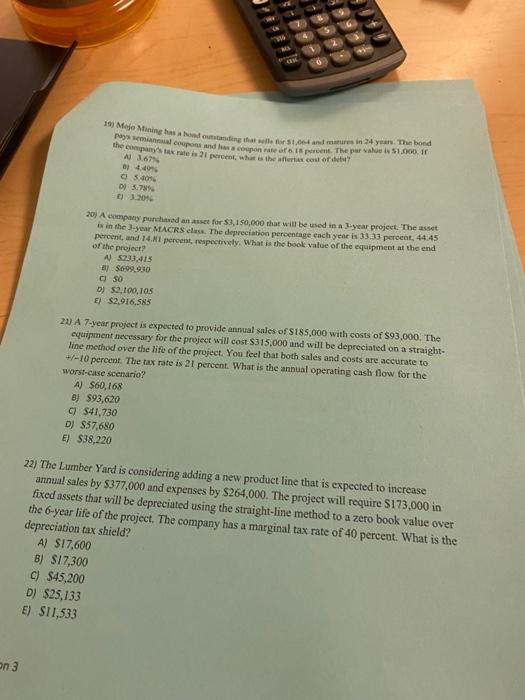

(A) 1.67+ b) 4,40+ () 5 . 10s= a) 5.73% (i) 130 is Percent, and 4 , kl peroent, respectively. What is ehe book value of the equipmacet at the end of the nraject? a) 5731,415 ] 9699,930 (c) D) 52, 100, 105 E1 52,916,585 21) A 7-year project is expected to provide annual sales of $185,000 with costs of $93,000. The equijment necessary for the project will cost $315,000 and will be depreciated on a straightline method over the life of the project. You feel that both sales and costs are accurate to +/10 pereent. The tax rate is 21 percent. What is the annual operating cash flow for the worst-case scenario? A) 560,168 B) $93,620 c) $41,730 D) 557,650 E) $38,220 22) The Lumber Yard is considering adding a new product line that is expected to increase annual-sales by $377,000 and expenses by $264,000. The project will require $173,000 in fixed assets that will be depreciated using the straight-line method to a zero book value over the 6-year life of the project. The company has a marginal tax rate of 40 percent. What is the deprechation tax shield? A) $17,600 B) $17,300 C) $45,200 D) $25,133 E) 511,533

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts