Question: 5. You are considering the following two mutually exclusive projects. The crossover rate between these two projects is percent and Project should be accepted

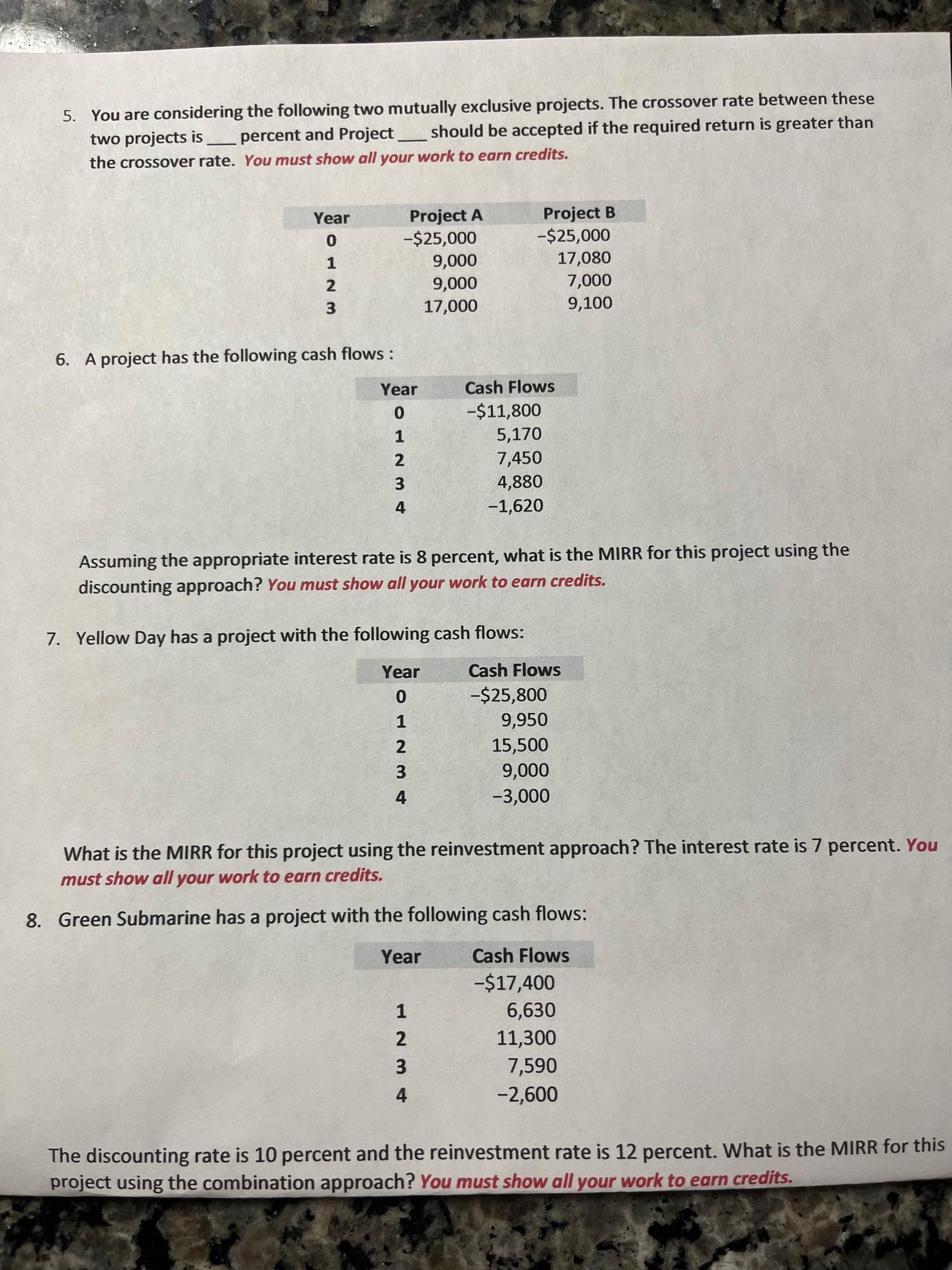

5. You are considering the following two mutually exclusive projects. The crossover rate between these two projects is percent and Project should be accepted if the required return is greater than the crossover rate. You must show all your work to earn credits. Year 0123 Project A -$25,000 Project B -$25,000 9,000 17,080 9,000 17,000 7,000 9,100 6. A project has the following cash flows: Year Cash Flows 0 -$11,800 1 5,170 2 7,450 3 4,880 4 -1,620 Assuming the appropriate interest rate is 8 percent, what is the MIRR for this project using the discounting approach? You must show all your work to earn credits. 7. Yellow Day has a project with the following cash flows: Year Cash Flows -$25,800 01234 9,950 15,500 9,000 -3,000 What is the MIRR for this project using the reinvestment approach? The interest rate is 7 percent. You must show all your work to earn credits. 8. Green Submarine has a project with the following cash flows: Year Cash Flows -$17,400 1234 6,630 11,300 7,590 -2,600 The discounting rate is 10 percent and the reinvestment rate is 12 percent. What is the MIRR for this project using the combination approach? You must show all your work to earn credits.

Step by Step Solution

There are 3 Steps involved in it

Question 5 Crossover Rate and Project Selection Given Data Year Project A Project B 0 25000 25000 1 9000 17080 2 9000 7000 3 17000 9100 Step 1 Calculate the Cash Flow Differences Between Projects A an... View full answer

Get step-by-step solutions from verified subject matter experts