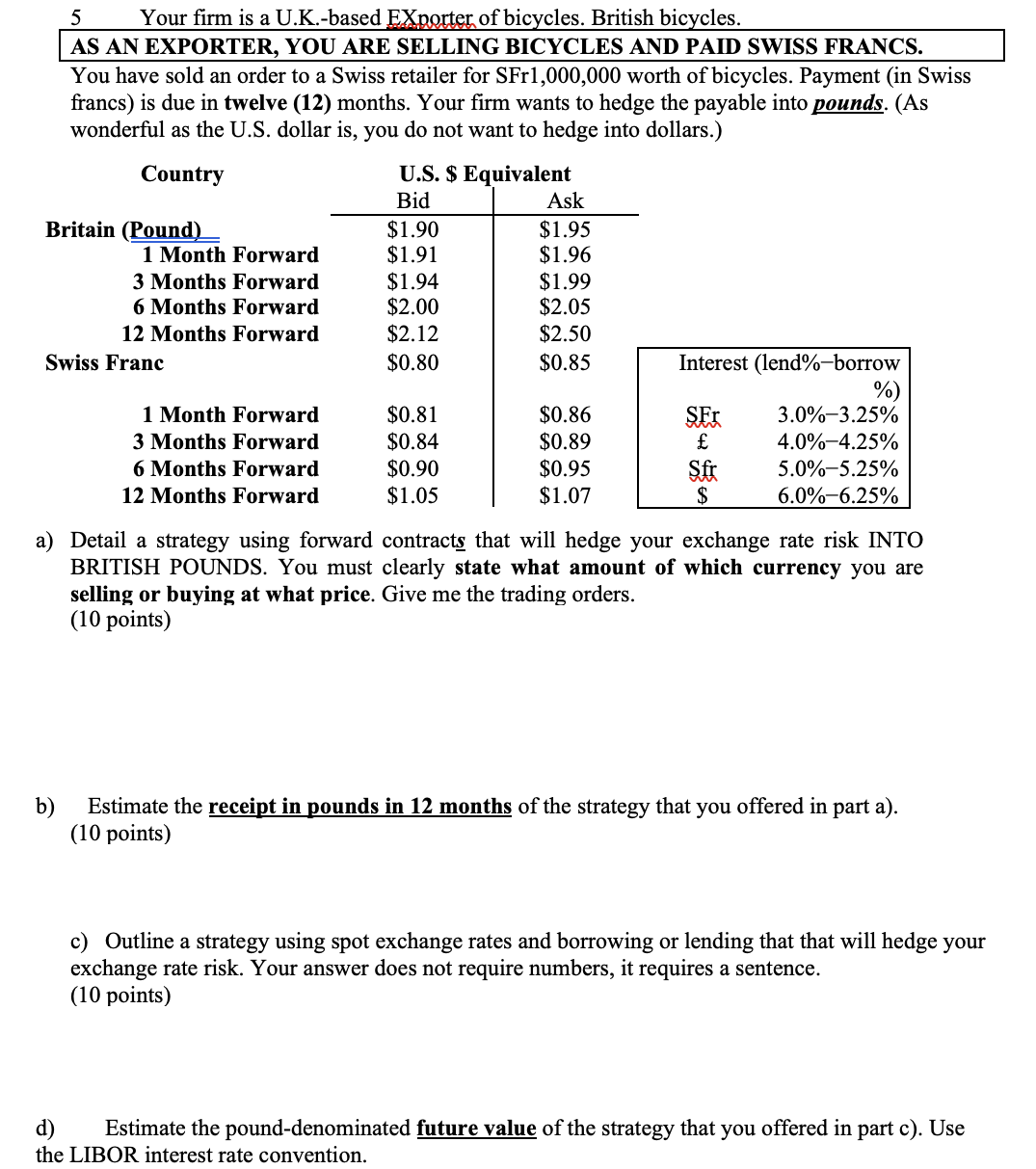

Question: 5 Your firm is a U . K . - based EXporter of bicycles. British bicycles. AS AN EXPORTER, YOU ARE SELLING BICYCLES AND PAID

Your firm is a UKbased EXporter of bicycles. British bicycles.

AS AN EXPORTER, YOU ARE SELLING BICYCLES AND PAID SWISS FRANCS.

You have sold an order to a Swiss retailer for SFr worth of bicycles. Payment in Swiss

francs is due in twelve months. Your firm wants to hedge the payable into pounds. As

wonderful as the US dollar is you do not want to hedge into dollars.

a Detail a strategy using forward contracts that will hedge your exchange rate risk INTO

BRITISH POUNDS. You must clearly state what amount of which currency you are

selling or buying at what price. Give me the trading orders.

points

b Estimate the receipt in pounds in months of the strategy that you offered in part a

points

c Outline a strategy using spot exchange rates and borrowing or lending that that will hedge your

exchange rate risk. Your answer does not require numbers, it requires a sentence.

points

d Estimate the pounddenominated future value of the strategy that you offered in part c Use

the LIBOR interest rate convention.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock