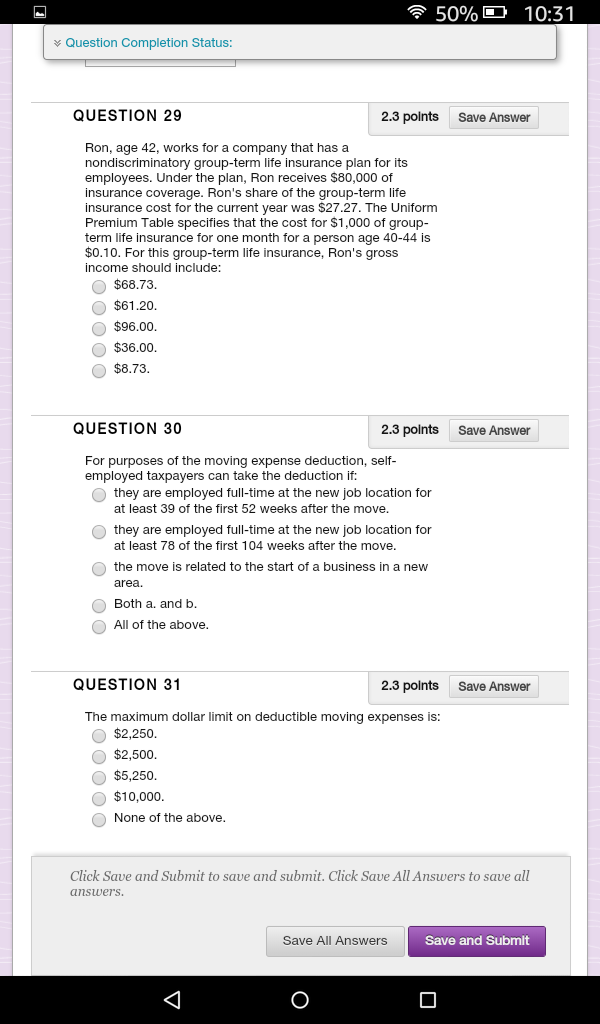

Question: 50% 10:31 Question Completion Status: QUESTION 29 2.3 polnts Save Answer Ron, age 42, works for a company that has a nondiscriminatory group-term life insurance

50% 10:31 Question Completion Status: QUESTION 29 2.3 polnts Save Answer Ron, age 42, works for a company that has a nondiscriminatory group-term life insurance plan for its employees. Under the plan, Ron receives $80,000 of insurance coverage. Ron's share of the group-term life insurance cost for the current year was $27.27. The Uniform Premium Table specifies that the cost for $1,000 of group- term life insurance for one month for a person age 40-44 is $0.10. For this group-term life insurance, Ron's gross income should include: O $68.73. $61.20 $96.00 $36.00 $8.73 QUESTION 30 2.3 points Save Answer For purposes of the moving expense deduction, self employed taxpayers can take the deduction if: they are employed full-time at the new job location for at least 39 of the first 52 weeks after the move they are employed full-time at the new job location for at least 78 of the first 104 weeks after the move the move is related to the start of a business in a new area. Both a. and b All of the above QUESTION 31 2.3 polnts Save Answer The maximum dollar limit on deductible moving expenses is: $2,250 $2,500 $5,250 $10,000 None of the above Click Save and Submit to save and submit. Click Save All Answers to save all answers Save All Answers Save and Submit

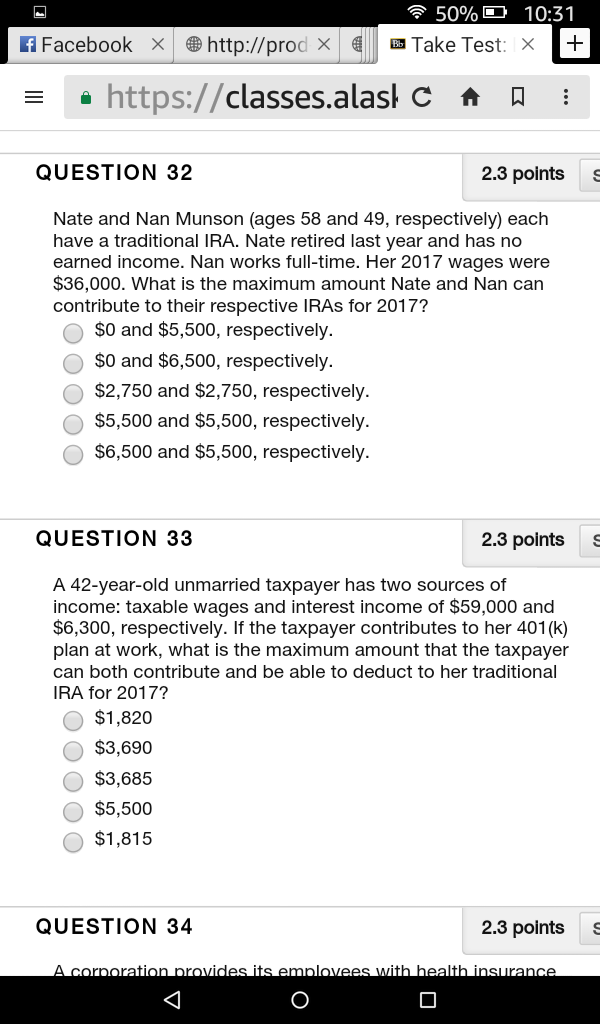

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts