Question: 5.1. Suppose that zero interest rates with continuous compounding are as follows: Maturity (years) Rate (% per annum) 1 2 3 4 5 8.0 7.5

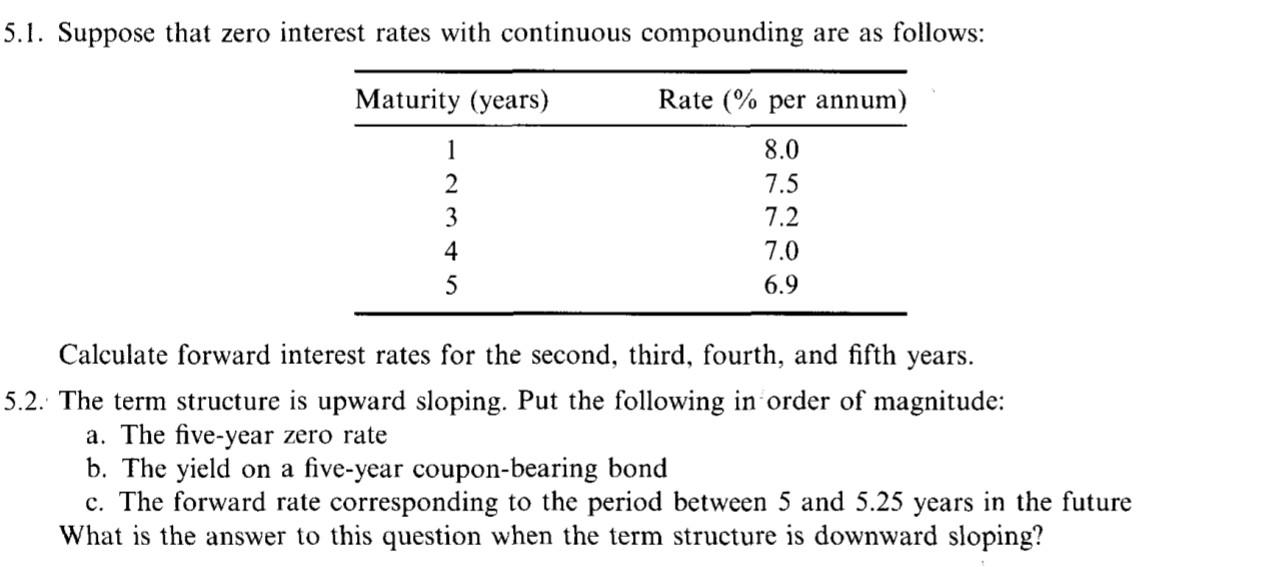

5.1. Suppose that zero interest rates with continuous compounding are as follows: Maturity (years) Rate (% per annum) 1 2 3 4 5 8.0 7.5 7.2 7.0 6.9 Calculate forward interest rates for the second, third, fourth, and fifth years. 5.2. The term structure is upward sloping. Put the following in order of magnitude: a. The five-year zero rate b. The yield on a five-year coupon-bearing bond c. The forward rate corresponding to the period between 5 and 5.25 years in the future What is the answer to this question when the term structure is downward sloping? 5.1. Suppose that zero interest rates with continuous compounding are as follows: Maturity (years) Rate (% per annum) 1 2 3 4 5 8.0 7.5 7.2 7.0 6.9 Calculate forward interest rates for the second, third, fourth, and fifth years. 5.2. The term structure is upward sloping. Put the following in order of magnitude: a. The five-year zero rate b. The yield on a five-year coupon-bearing bond c. The forward rate corresponding to the period between 5 and 5.25 years in the future What is the answer to this question when the term structure is downward sloping

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts